Welcome back everyone!

Starting today's post, I will be covering the SPX Put contracts along with the SMCI Swing Puts mentioned in the chat. Here is a summary of what was discussed and the final results:

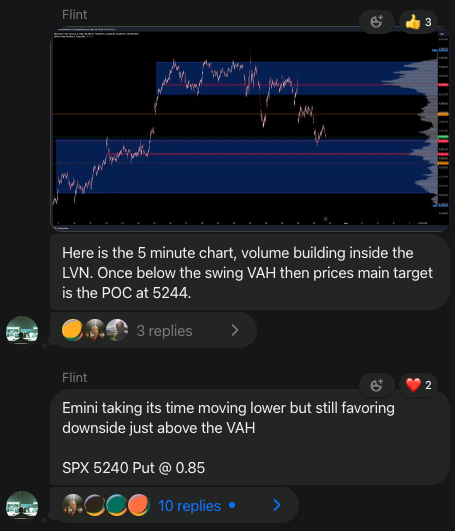

These contracts experienced an impressive increase, moving from 0.85 to 19, which equates to a 2,100% gain after being called out.

Additionally, SMCI continued to decline after hours, following a sharp sell-off post-earnings report from DELL.

The SMCI contracts were called out at 2.9 and are expected to open around 22, resulting in a 650% gain.

This has been an incredible week, with many subscribers seeing significant returns on their contracts.

Now lets get back to recapping the levels posted last night!

Indices:

Both the Emini and Nasdaq declined from the short levels today, reaching the short targets. The Emini sold off from the swing Value Area High (VAH), moving all the way down to the swing Value Area Low (VAL). Support was maintained here into the close before continuing lower into the overnight session.

Turning to the Nasdaq, the price managed to break below the swing VAH, selling off right down to my target, which was the low of the day, including the overnight session.

Commodities:

Oil once again exceeded my expectations with a substantial sell-off from the short level. The price declined to the target, which served as support for a significant portion of the session before continuing lower towards the swing Value Area Low (VAL).

Gold experienced increased volatility in the previous session. The low of the session corresponded to the long level, offering a potential upside of 21 handles.

Stocks:

The chart below illustrates SMCI, which has dropped over 100 handles since Tuesday's chat update. Every single session has been marked by declines, with the 800 target being achieved in today's session.

This consistent downward movement over multiple sessions highlights the strong bearish momentum in SMCI. The achievement of the 800 target demonstrates the effectiveness of the analysis and calls made in the chat update.

Make sure to show some love by dropping a like if you enjoy reading this post!