Welcome back everyone!

Kicking off today's post, I will be covering the two stocks that reported tremendous earnings, working in our favor, along with the SPX contracts called out in the chat.

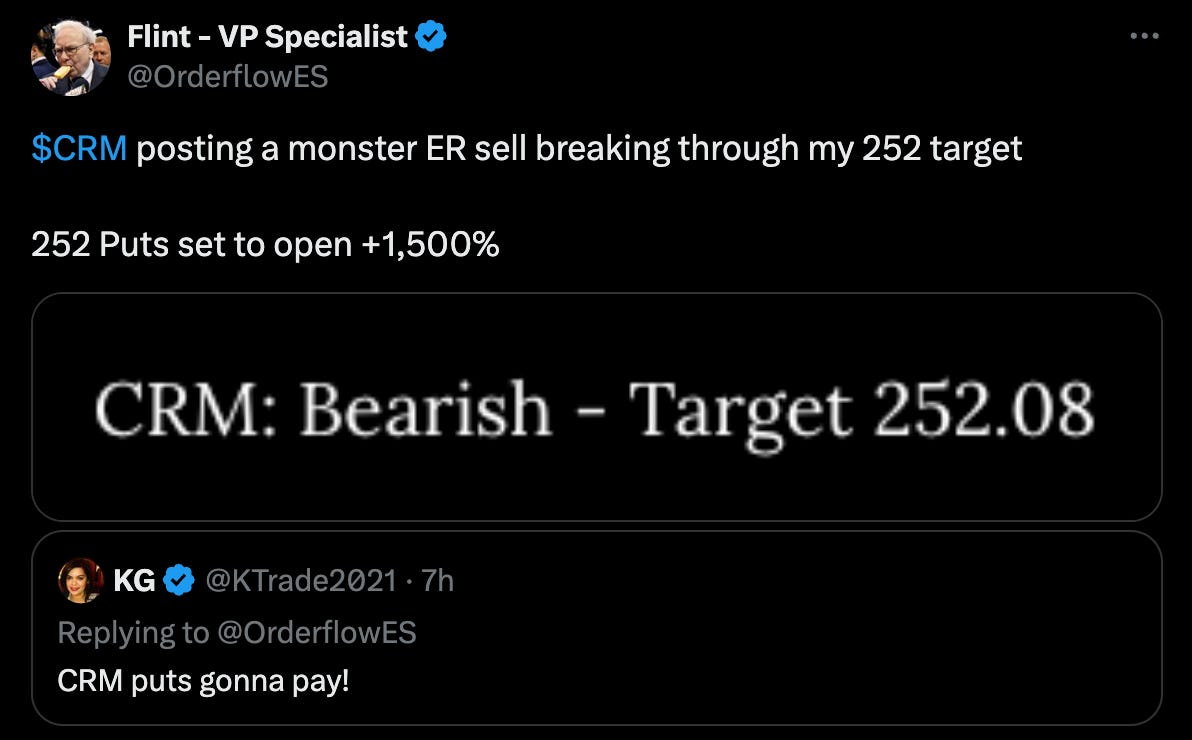

CRM: Bearish - Target 252.08

A: Bearish - Target 140.40

Both of these earnings calls came to fruition, resulting in massive moves in contracts using the strikes closest to the targets. Currently, these contracts are set to bring in a net gain of 2000% on puts. Here is how I expect them to perform at tomorrow's open:

SPX updates sent out in chat:

Contracts saw a move from 0.85 all the way up to 5.5 for 550%.

Indices:

E-mini and Nasdaq both experienced a significant sell-off from the short levels, leading to a sharp decline through the short targets. Unfortunately, selling intensified after the close, which could have resulted in SPX contracts yielding over 1000% on Puts today. I discussed the recent market dynamics at the end of the sessions, highlighting how they have made it much harder to capitalize on the 0DTE EOD contracts called out live. Despite these challenges, there were numerous opportunities to profit from futures and options related to the indices.

In the chart below, you can see the E-mini's swing VAL, marked by the blue zone, acting as a key resistance level and triggering a sell-off all the way down to the next swing value area within a single session. I frequently discuss these movements in the Flow State videos. Those who can access these videos, along with active chat users, do not miss out on these key opportunities. The detailed analysis and real-time discussions help traders navigate these market shifts effectively.

Commodities:

Oil showed limited movement both to the upside and downside during the session, as the price attempted to decline towards the swing VAH. The session concluded with the price just above this level.

Gold, on the other hand, experienced significant selling pressure. The price dropped below the short level, continuing its descent all the way down to the target, which marked the low of the session.

Stocks:

SMCI, which was highlighted in the chat during yesterday's session, experienced a massive rally, resulting in Put contracts gaining over 35 handles of downside in today's session. This significant movement provided substantial profit opportunities for those who acted on the call.

On the other hand, TSLA, which was also called out with Puts shortly before, displayed some balancing, not showing as much weakness as anticipated. Despite this, it remains an important stock to watch. Further updates and analysis on TSLA will be provided in the chat, so stay tuned for more detailed insights.

Make sure to show some love by dropping a like if you enjoy reading this post!