Welcome back everyone!

MONDAY IS MEMORIAL DAY SO THE MARKETS WILL BE CLOSED!

Before covering the Indices, Commodities and Stocks I just want to highlight what took place in chat today.

Todays notable earnings which were covered for the last two days, including last nights reports:

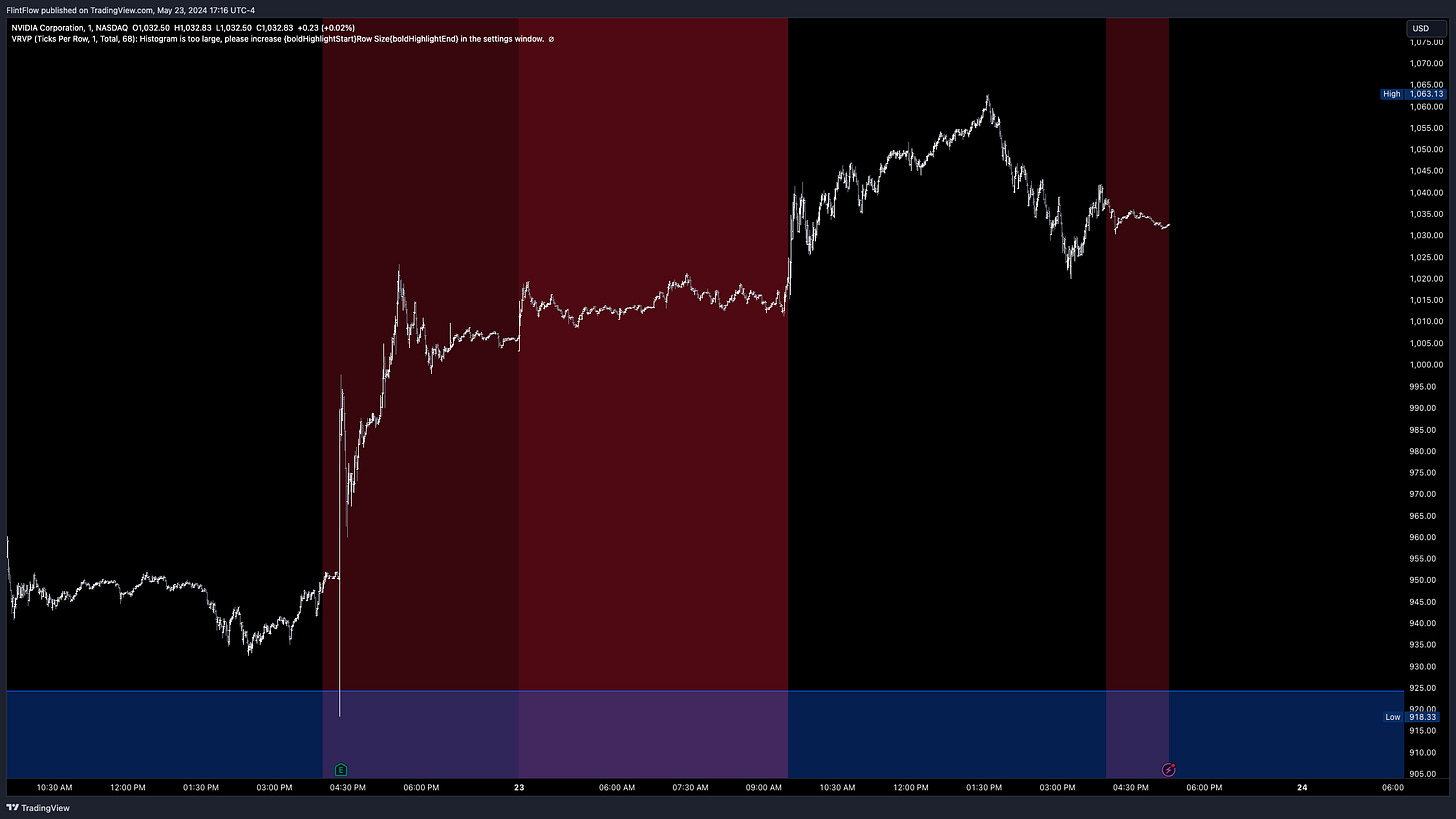

NVDA: Bullish - Target 1080

As anticipated, a massive rally occurred, significantly boosting the contracts. During the session, I sent out an update on the contracts I was monitoring, specifically the 1000 and 980 call options. The 1000 strike calls surged from 16 to 64 today, achieving a remarkable 300% gain. Below is the update I shared in the chat yesterday:

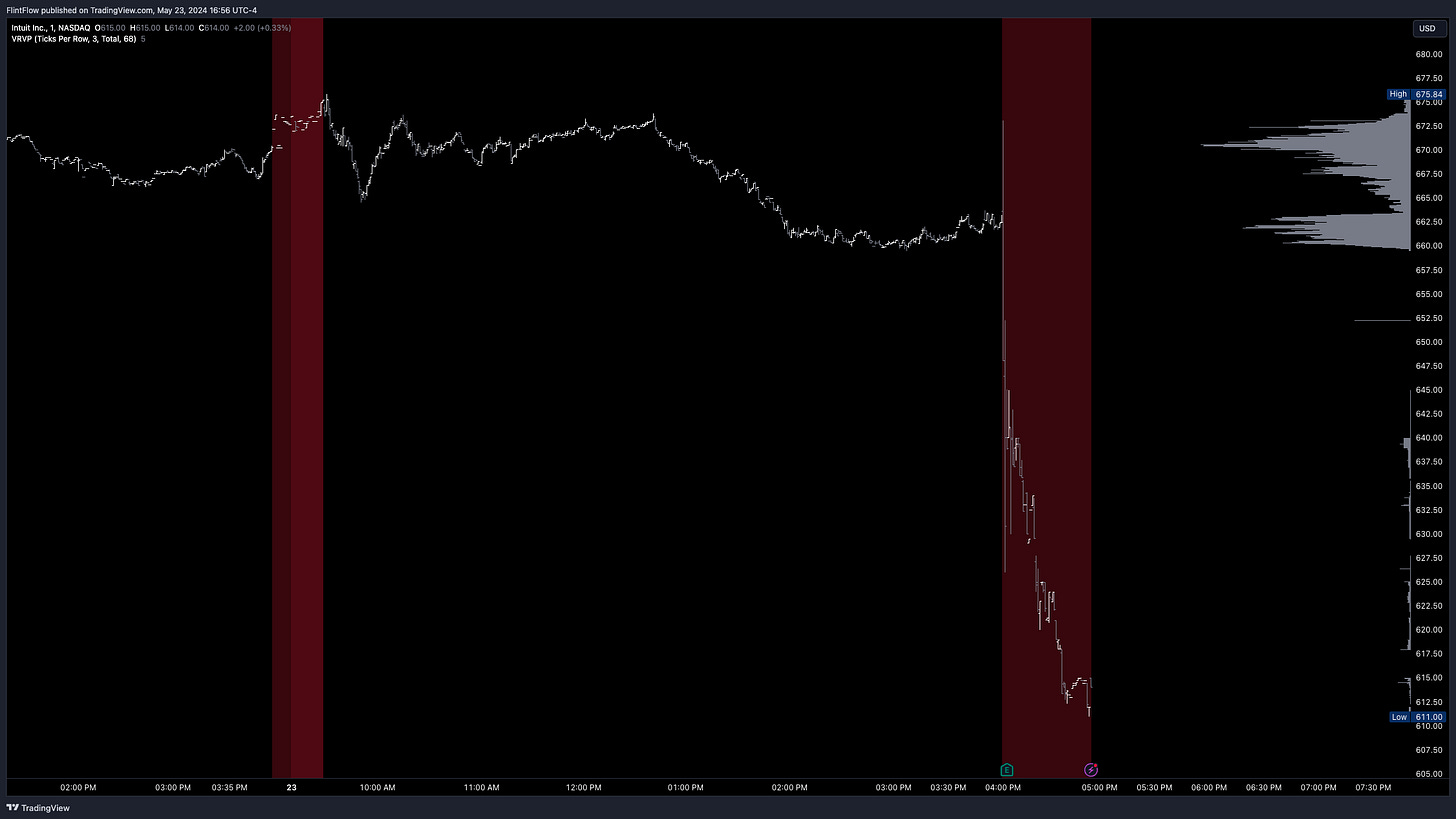

INTU: Bearish - Target 637.95

INTU is experiencing a significant gap down, breaking below the target level. Based on the option strikes being used, the 637.5 puts are projected to increase by over 300%.

ROST: Bullish - Target 138.86

On the other hand, ROST managed to spike above the target, pushing the 138 strike calls up by over 200% for tomorrow's open.

Now moving on to the overall recap.

Indices:

Today was an incredible session characterized by high volatility, which resulted in substantial upside and even greater downside movements. Both the E-mini contracts started the session by selling off from the long targets after rallying from the long levels overnight. This was followed by a sharp sell-off from the short levels, leading to continued selling through the short targets.

When trading options, I typically wait until the end of the day (EOD) to catch a move due to the consistent decay of premiums throughout the day. Today, I aimed to capture a bounce into the close, but prices continued to decline, rendering the calls worthless.

Overall, prices on both indices closed at key levels, which will be discussed in detail in the levels for tomorrow. Additionally, updates will be provided throughout tomorrow's session in the chat.

Commodities:

Oil experienced a strong bounce from the swing Value Area Low (VAL), which is why I had set the long level just above it. The price rallied all the way up to the long target, reaching the Point of Control (POC), a magnet due to the highest volume of trades at that price. Subsequently, the price sold off below the VAL, continuing past the short level, which served as a key resistance for the remainder of the session.

Gold, on the other hand, exhibited weakness from the start, with selling pressure emerging directly at the short level. The price declined, moving down through the short target, capturing most of the selling activity, although some selling was missed. Overall, the majority of the move was contained within the levels.

Stocks:

GE experienced a strong rally towards the end of the week, breaking the highs set earlier in the week. Although the recent rally was impressive, the spike in premiums last Wednesday was more significant, as time decay had been eroding the value over the last two sessions.

Make sure to show some love by dropping a like if you enjoy reading this post!