Daily Plan 5/24/23

Good morning traders!

Yesterday was yet another great session as both Emini and stocks gave plenty of opportunity. The uptrend finally broke to the downside bringing large sells in many of the big tech names that have been on fire recently. For todays plan we will quickly cover how yesterdays levels panned out and then move into my thoughts for today.

Yesterdays Recap

ES

Attempted to break above 4200 early in the session while PMI released but there was no follow through. Once below 4180, the rest of the session consisted of selling nearly moving down to 4137 target.

Short level was in play all session which began selling the same time as Emini. As we move through this week I believe apple will take a big hit to downside which will spike the 6/2 swings I have pointed to last week.

Another session of a straight up spike off the long level for a very quick and easy trade. then later once we broke below short level this sold more OVN down into 183!

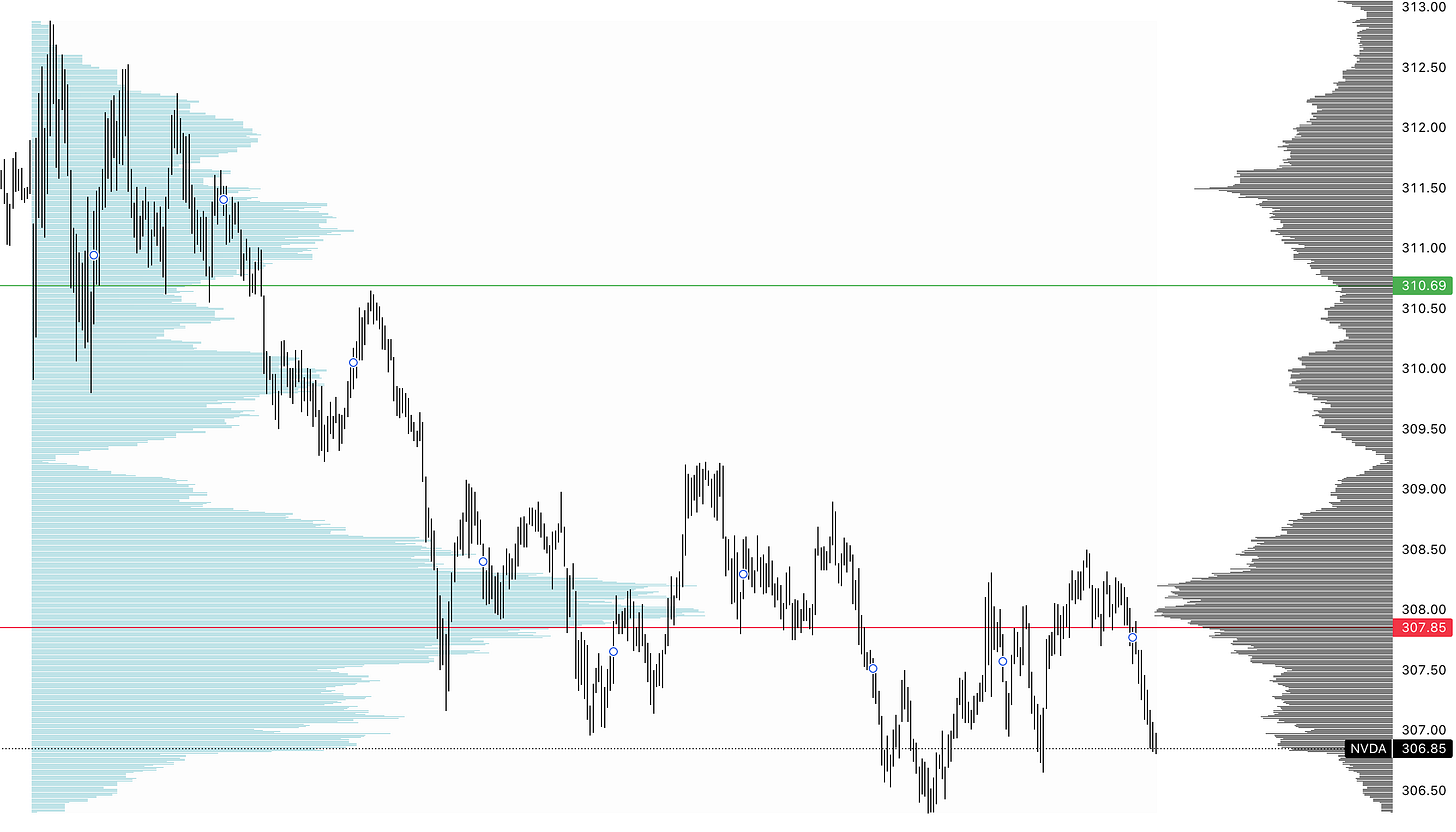

Same as Emini trying to hold up trend early in the morning to later bleed out the rest of the session. This is another name that has continued selloff OVN down to 303 slicing off 4 handles.

This brought a fast spike at the open like previous sessions but showed much more weakness today not able to move much away from the level. After failing to remain above, price sold off the rest of the session offering 4 handles continuing sell through the night.

This is a clear change based on the last week of selling while the rest of stocks have been on a tear upward. Today this reversed and spiked while most stocks were selling off. I do think this is shorts covering and may continue selling today. Selling can really pick up the pace below 114.80.

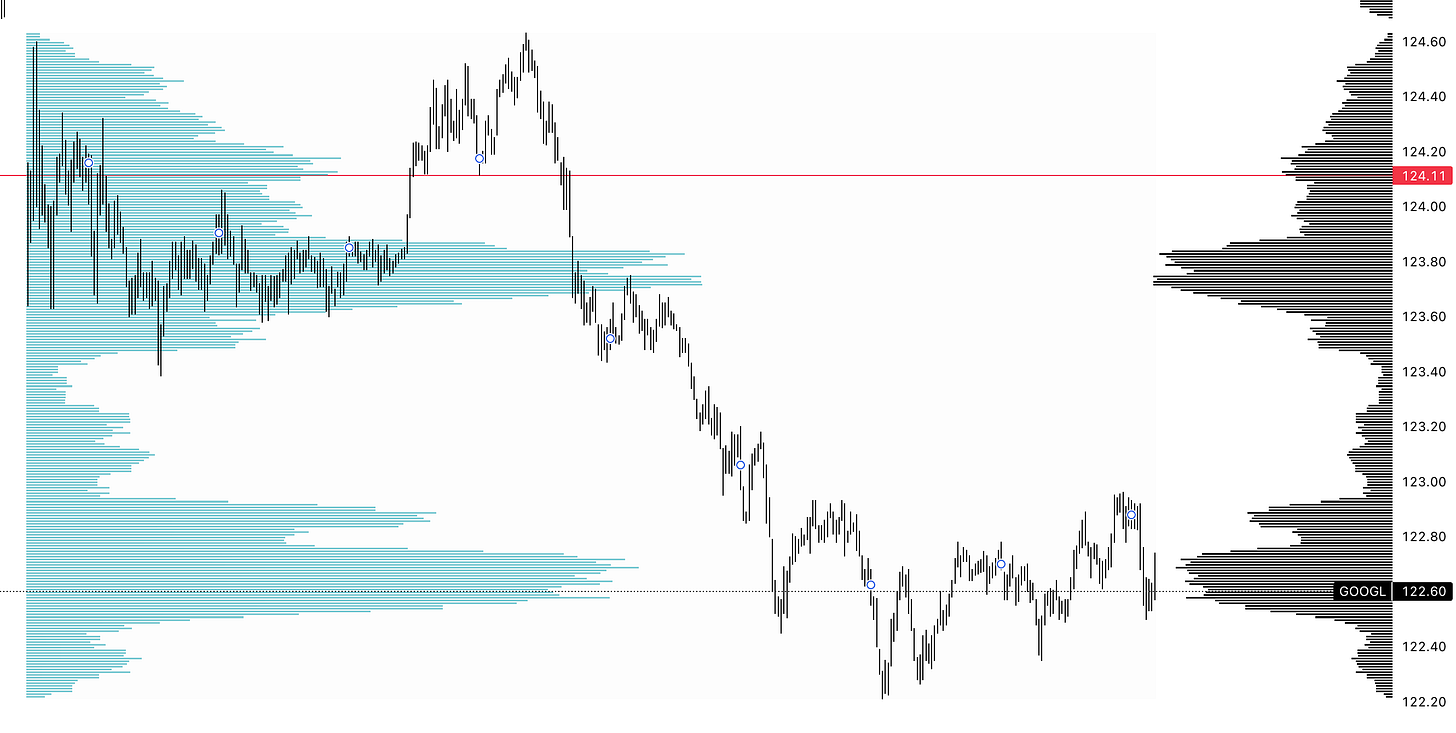

Other than spiking out the open right from long level, this generally moved the same as Nvidia while appearing much stronger. Offering a 4 handle spike to the upside for a very fast rally to session highs at 111.

Short level was nearly HOD offering large sell which continued through the night. If you compare the charts from yesterday you can see a LVN nearly halfway up/down the profile that once below held prices for the entire session. This LVN is a great area to move LIS just above when taking shorts. These profiles are known as B.

This one was tricky, if you look back to the other stocks that spiked at the open then based at long level, they actually sold off shortly after while Meta sparked further upside. Ultimately this sold back down breaking short level and selling off OVN offering plenty of downside.

Moving on to todays thoughts for the S&P500.