Welcome back everyone!

Before covering the Indices, Commodities and Stocks I just want to highlight what took place in chat today.

Todays notable earnings which were covered for the last two days:

NVDA: Bullish - Target 1080

NVDA has seen a sharp rally above 1000, meeting my expectations, which I discussed in more detail in the chat today.

ADI: Bullish - Target 232.14

ADI moved right up to the target, resulting in a 2,500% rally in 232 Calls.

Outside of earnings, there was plenty covered in the chat. I shared my thoughts early in the session, predicting we could see an upside, but this prediction fell apart leading into the FOMC Minutes. The calls concluded with a 1R loss, but later in the day, I identified calls at the lows, which went from 0.95 all the way up to 9.7, resulting in over a 1,000% gain. Here are the updates sent in the chat:

Now moving on to the overall recap.

Indices:

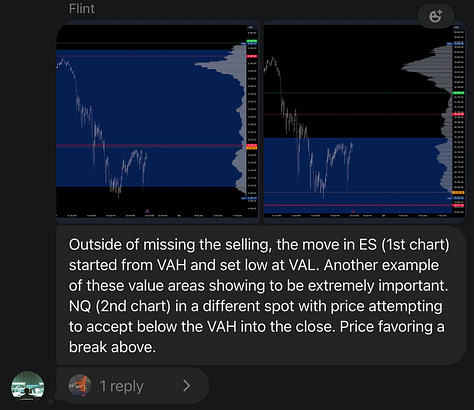

Today provided another prime example of the significance of value areas as key zones where price reacts. The E-mini futures demonstrated this, with the high reaching the swing Value Area High (VAH) and the low hitting the swing Value Area Low (VAL) within the same session. This behavior aligns with my earlier comments about expecting such movements in sessions driven by catalysts that induce volatility.

Turning to the Nasdaq, there was a clear indication that the sell-off might not persist. The price failed to stay below the swing VAH, which led to a sharp rally, pushing the price up to new highs.

Commodities:

Oil once again experienced selling pressure, resulting in six sharp moves from the short level to the short target. Today was a phenomenal session for trading oil, continuing a trend that has persisted for many weeks.

Gold experienced more selling than I anticipated but managed to stay below the swing Value Area High (VAH), which marked a key resistance level for the entire session.

Stocks:

Nothing changed from previous session.

Make sure to show some love by dropping a like if you enjoy reading this post!