Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

The E-mini overall had an excellent session, maintaining an upward trajectory throughout the day, staying above the long level. Right at the open, the price broke above the long level, setting the stage for a bullish session. The upward momentum continued throughout the day, with a notable bounce off the long level around midday. The session concluded with the price reaching the long target, which was capitalized on through SPX contracts.

The SPX 5320 Calls were at 1.4 when mentioned in the chat and surged to just above 6.5 by the close. This represents a gain of over 300%, realized by the end of the session.

In contrast, the Nasdaq took more time to rise to the long level due to overnight selling pressure that brought the price down to the swing value area POC. By the end of the session, the price began to curl upwards, indicating strong upside potential, but it fell short of reaching the long target.

Commodities:

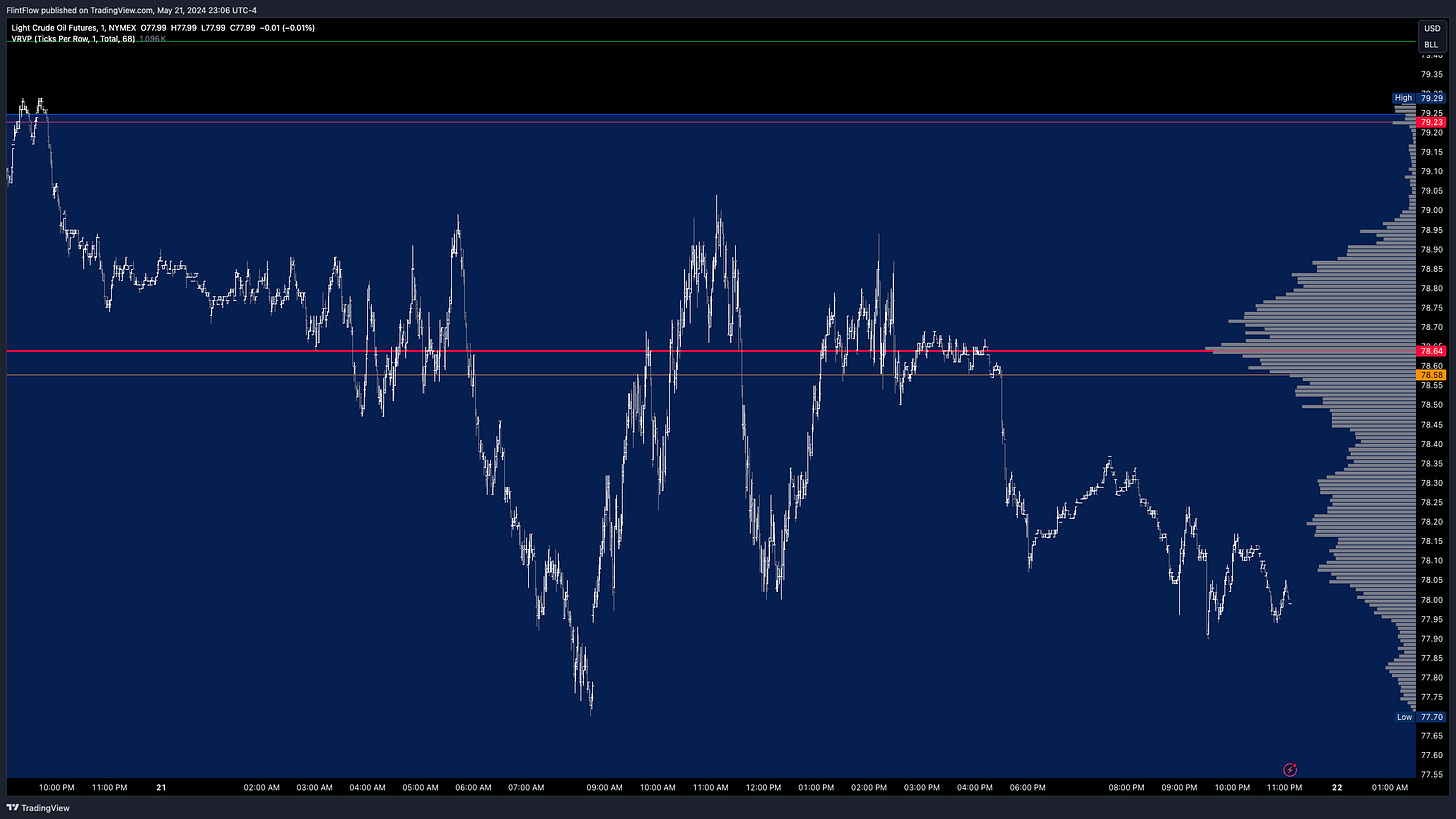

Oil started its move overnight, initiating a sell-off that drove prices down to the short target before continuing to decline throughout the session. Overall, we positioned ourselves correctly for this move. Although we did not capture the entire downward trend, it was beneficial to align with the prevailing price action rather than opposing it.

Gold experienced a mixed session. Initially, it broke below the short level, nearly reaching the short target. Following this, there were minor movements below the short level before the price reversed and broke above it, resulting in one strong upward move past the long level. Despite the short target being almost hit early in the cash session, the overall performance was mixed when considering the established levels.

Stocks:

Cisco Systems (CSCO) experienced a continued sell-off, dropping down to the 46.80 target that was identified and shared two days ago. Contracts, which were recommended in the chat at a price of 0.15, reached a high of 0.50 today, demonstrating a significant increase.

Microsoft (MSFT) continued its impressive two-week rally, which was anticipated well in advance. This sharp upward move significantly boosted this week's contracts, with premiums rising from 4.5 when initially provided to 16, marking a substantial gain.

Amazon (AMZN) showed a strong rebound after opening with a gap down. Premiums on calls are being recouped and are positioned to capitalize on potential gains tomorrow. These opportunities were also discussed in the Substack chat.

Make sure to show some love by dropping a like if you enjoy reading this post!