Daily Plan 5/22/23

Good morning traders!

Yesterdays levels were robust with nearly every level working offering plenty of opportunity throughout the session.

First, let’s dive into what was said and how exactly that played out.

Emini beginning to build up value near VAH 4192 which if holds I expect a move back up through Fridays highs up at 4227 and extension further to 4280. Failure to hold above VAH may bring a sell down into 4140 POC. At the time of this post, Emini is trading above 4192 VAH at 4205.

As you can see and probably already knew, 4192 was the LOD (Low Of Day) holding up all session. Emini along with Nasdaq holding up today brought further strength to tech. Some of the stocks in the Daily Plan set LOD at the long level while remaining strong for the entire session.

Below I will provide thoughts from yesterdays Newsletter along with chart to go with.

Apple - As long as we remain above 171.5 which was defended last week I expect this to keep pushing up to ATH. Trend remains up which 171.5 will be the first step to breaking out of this trend. While above I will look for longs for a push up into 178-180.

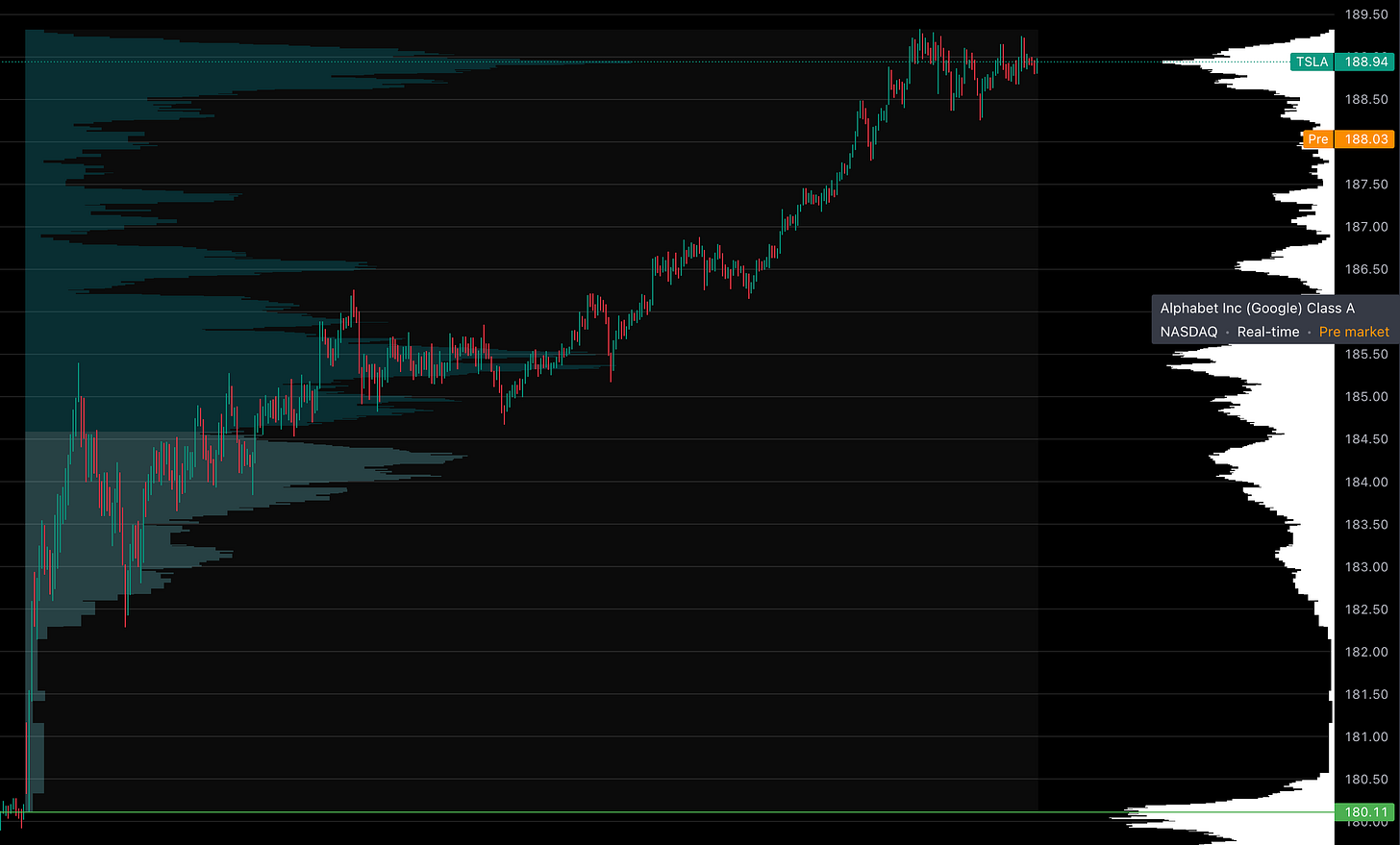

Tesla - All the names listed in this section are robust looking for a push higher. This needs to hold above 176.5 this week for a push higher up to 192.

Nvidia - As long price remains above 307 I expect further continuation through Thursdays highs and set for ATH just like Apple. This is not saying either will break highs but at this rate with trend it is very possible on both.

Google - This has been a stock will little to no downside on the way up which is holding up in PM. If this can remain above 121 I expect to see a move up to 128-130.

Amazon - This has seen wider swings on the way up so I will give this more room for a chance to break back up through previous weeks highs. As long as this remains above 114.5 I will look for longs up to 122.

Microsoft - This is much stronger than the rest with PM prices sitting at last week highs and ready for a move higher early on this week. With all the AI news this can bring a large move up to 330.

Nonetheless these levels have offered little to now downside with extreme upside. Many of the weekly targets nearly were achieved all in yesterdays session. This was without even breaking above 4227 Emini as planned. As long as this trend remains valid I will look to take more of this upside momentum not only in the indexes but in stocks as well. Rather trying to pick a top, waiting for the confirmation of uptrend invalidating is the lowest risk with high reward setup. Until then I will continue to look for longs but I do want to warn of shorting the breakdown of this trend. Even if we break a level to the downside and this can invalidate the trend, price many times will give false breaks and rally right back over that level within days if not the same session. Once this starts to sell I will keep very tight risk with ability to flip long if needed.

I also want to point out what the bounce of 4192 means.