Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

Both indices once again respected the long levels, reaching their respective long targets. The interesting part about this move was that while the Emini saw selling below the swing Value Area High (VAH), the Nasdaq broke above and held the swing VAH as key resistance for the rest of the session. Just last week, the Nasdaq experienced more selling and was unable to rally like the Emini. However, today presents a complete shift, with the opposite being the case.

Commodities:

Oil attempted to rally above the long level, nearly reaching the target. However, it ultimately sold off, breaking below the short level and setting the low just above the short target.

Gold quickly rejected selling below the swing Value Area High (VAH) before rallying above the long level, posting gains for the remainder of the session. Although there wasn't a continuation up to the long target, there remains significant upside potential to capitalize on.

Stocks:

Three more stocks were discussed in the chat, with my analysis also providing contracts that can be effective if the price moves as I anticipate. These will be included in a recap once the setups are complete, so you will not find them among the stocks listed below.

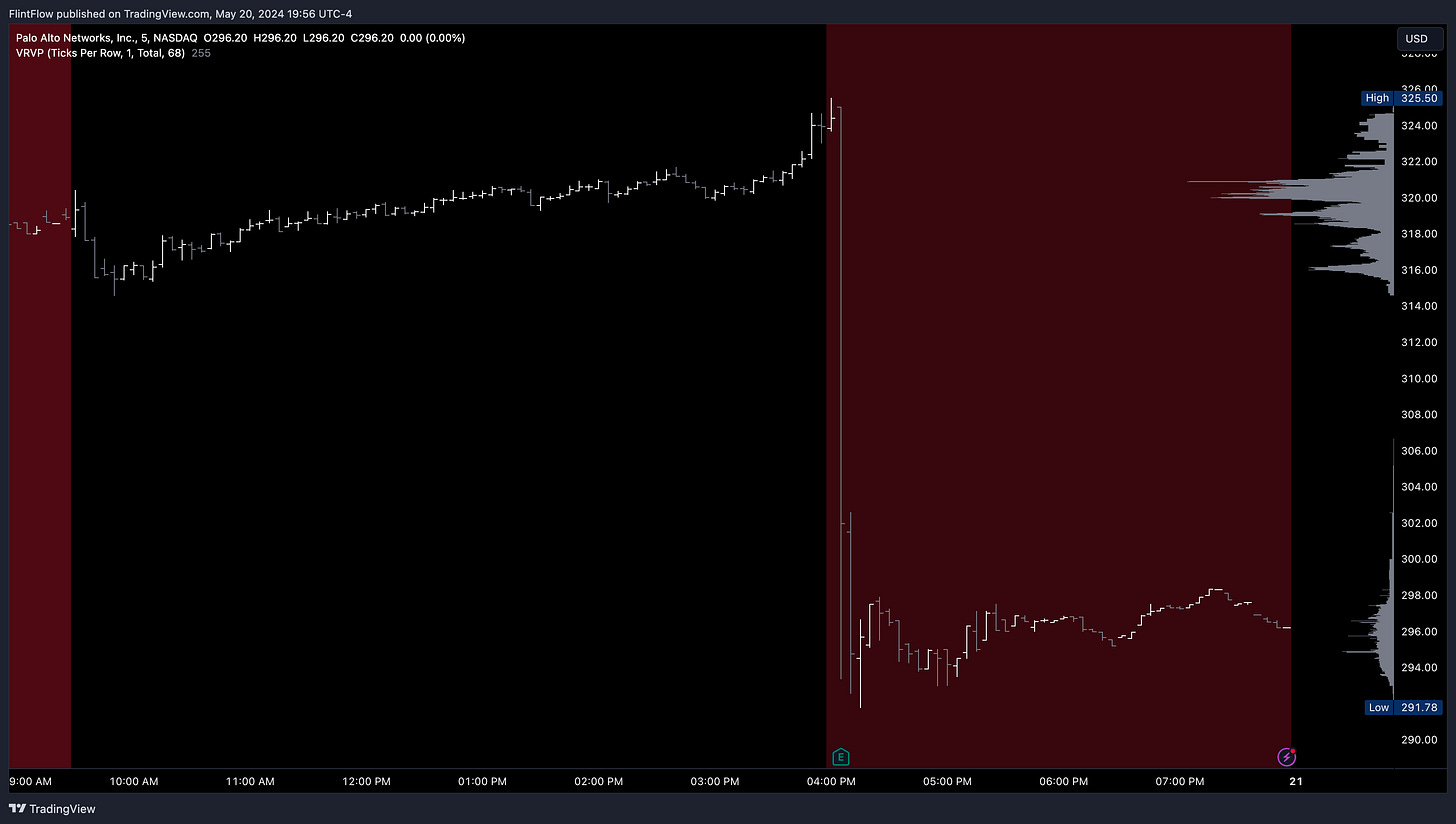

PANW's earnings report came out after the close today, leading to a significant selloff of over 30 points. This movement fell just short of the 280 target posted last night.

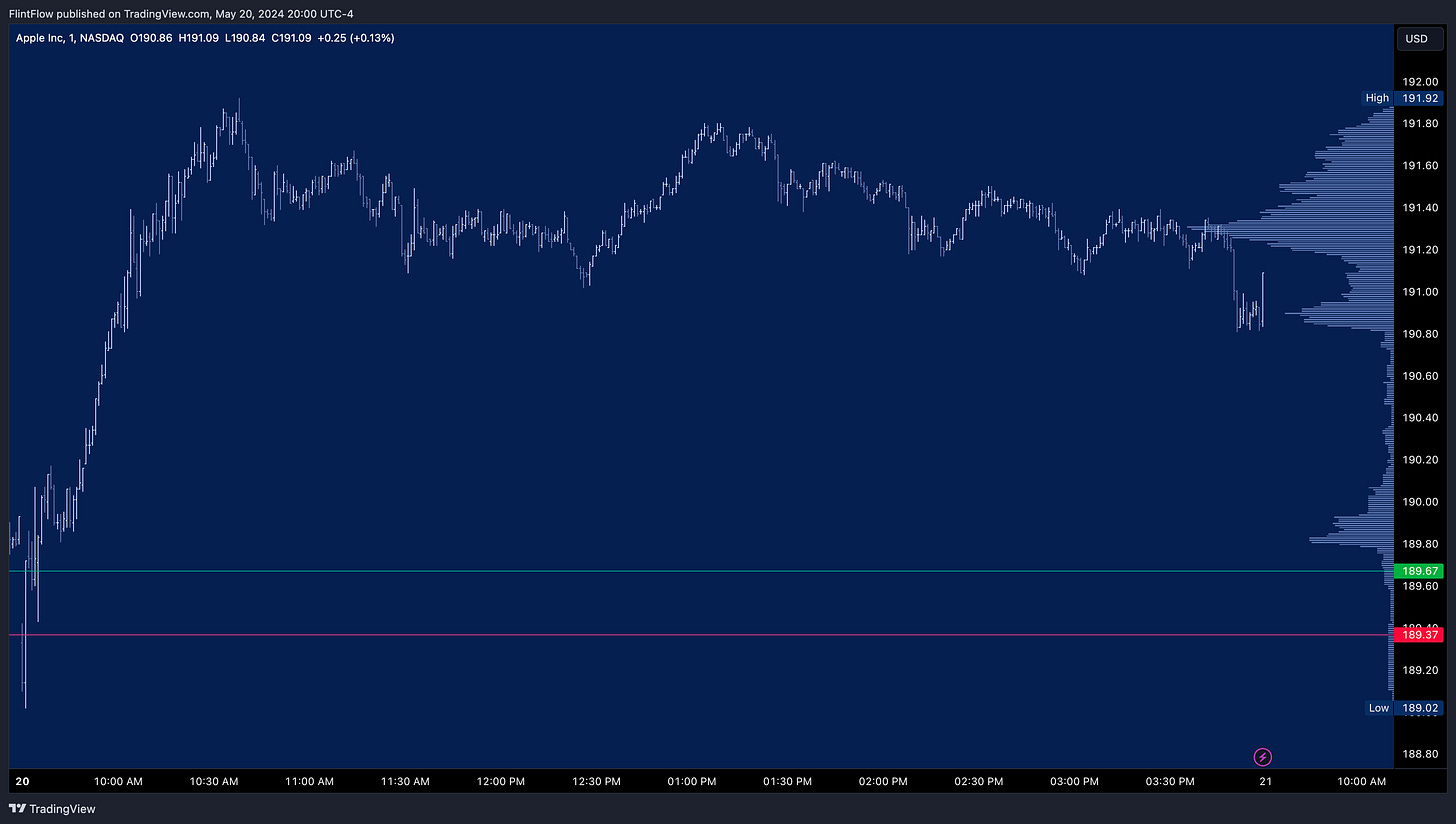

MSFT, AAPL, and NVDA saw sharp gains early in the session, presenting an excellent opportunity for a quick intraday trade on calls. This intraday rally has clearly established support at the highs, which I will consider as a long level for continuation higher tomorrow.

AMZN, on the other hand, experienced a strong spike but reversed the entire move, closing in the red for the day. The price even fell below the short level and closed below it. Without divulging too much information that was covered in the chat, I provided my thoughts on this stock with a swing setup for option contracts. A recap of how this played out will be provided soon.

Make sure to show some love by dropping a like if you enjoy reading this post!