Daily Plan 5/19/23

Good morning traders!

Hope everyone had a great session yesterday as we saw plenty of opportunities on the continuation move higher in Emini & Nasdaq. We also saw clear defense above 4160s for a move up to 4192 VAH in which sellers stepped in for about 2-3 hours. This was just as expected offering a sell of 19 handles down to 4173. See below what my thoughts were for yesterdays session.

Session Roadmap: Hold price above 4160 for continuation up to 4192 VAH. From here I want to see sellers step in again for a move back down into 4160s. If 4160s is not supported today 4137 POC will be area to potentially see buyers step in.

On the chart above, I marked two areas where the roadmap came into play, The bounce of 4160s and the sell from 4192. While the market is much higher into the close this was not something that brought pain to the 4192 shorts. After we snapped off this level to the downside, there was signals that this sell was drying up. Notice off 4192 there was an avalanche of sellers but as we got into 4170s where value was built up for the session, there was no follow through. It is easy to move price through a LVN but to actually break price outside value is a very tough task. As you move up in timeframe from intraday profiles to weekly or even monthly you will see where these key levels are. 4192 VAH is one of them. Looking at yesterdays profile you can see value built up for most of the session at 4175-4198. Once price began to move back up to 4198 it was clear warning we could see a strong move higher into the close.

As everyone can see now, Emini spiked 15 handles into the close to a NHOD.

Nasdaq was the exact same!

The same stocks have been consistently moving higher off of AI news and as much as hearing this is annoying, it’s true. CTAs along with most investors have moved into these tech names but not just for the reason of AI but as a shelter. They think these stocks will hold up much better and can escape any drawdown pain. Knowing this it does not interest me to be short in these names especially on a shorter term timeframe. Most were expecting these tech names to bomb earnings but as we have seen this wasn’t the case. I have said a few times now that until these companies post large declines in sales they will remain strong.

With that said what should you focus on for downside?

Companies posting negative earnings and the stocks these investors are fleeing out of to buy tech. Most have already fallen but I do see more pain ahead as long as FED keep rates high. A pause or further hikes will bring more pain outside of these tech names.

Target just posted earnings which brought a rally the next morning which I was thinking it wouldn’t hold. As many already know there is a massive amount of stolen goods from each store on a daily basis which is destroying profits. In a world where they will fire you for protecting the goods of your store is flat out ridiculous. You see security nowadays and there’s no intimidation so these thieves know they can steal and walk out untouched.

You know what companies like TGT 0.00%↑ WMT 0.00%↑ and many others have done? Facial recognition on self checkout machines and they know everything your doing and what was and wasn’t scanned. Many customers are finding out that later with law enforcement showing up at their doors. Instead of stopping the crime they will expect you to slip up and allow law enforcement to deal with the issue.

This is exactly why they have started locking goods behind cages, has nothing to do with the prices. Criminals will hit easy targets and Target is an easy target knowing the workers will do nothing.

Stock down 7 handles yesterday with contracts going 1.78 > 6.7!

Snapchat has dropped from 11 all the way down to 7.8! Plenty more to go down with earnings already being garbage.

Disney was a Earnings trade called out at 101 which stock dropped to 90.73 and expecting further decline with all the bad news flowing in the wind. All these battles with Florida is only making them look bad. Nobody is seeing this and thinking I NEED to go to Disney or I NEED to tell others to subscribe to Disney Plus. This only loses customers and looks bad on them. Legal battles are very serious for companies no matter who you are.

TOP Financial Group rallied from low 3s to 256 which is a very common pattern seen on any stock that goes parabolic in a short timeframe. Longer timeframes it is very common for companies to later go parabolic on good business practices. The ones that do this quickly always come down just as hard as they rose and many times they come down much fast. This stock was called out at 170 selling all the way back down to 6!

C3.AI (AI) has been an absolute monster up over 52% from 18 hitting 28 yesterday. This one was a no brainer as all these tech stocks have been screaming “AI” for weeks now. This ticker is AI, anybody wanting to invest in AI will simply search AI. Add in who they work with: Amazons Web Services, Baker Hughes, ENGIE, Fidelity National Information Services, FIS, Google Cloud, Microsoft, and Raytheon.

Very attractive tech names along with Raytheon! Potential for government contracts is a powerhouse for riches in the long run. If there’s something our leaders will put money into, it’s the military.

I can’t speak much on this but I have seen AI used in Military equipment and it is the future. Something everyone will learn is every super power take pride in having strong military power. Once one starts using AI, they all will.

This stock will be a massive winner in the future.

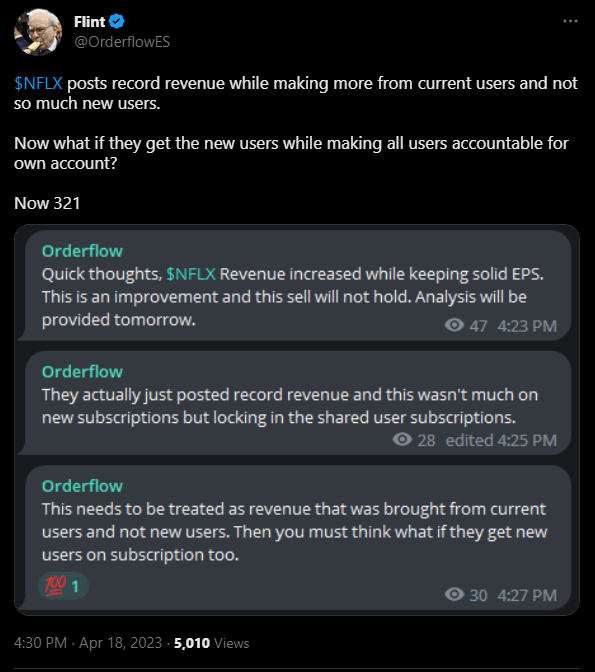

Netflix was another earnings trade which saw a selloff post earnings in which I brought very simple analysis to this. The major change seen was the password sharing ban. This will allow the company to make sales from everyone rather than one person who shares with 3-5 other users. The company has come forward that they have over 100 Million HOUSEHOLDS sharing accounts. 40% of total households using Netflix are sharing passwords but note this is in just the US and other countries numbers will vary. I could care less if they saw a decline in earnings for the quarter as the potential to get same customers who are sharing to pay is far easier then having to get new customers.

Stock given at 321 hit a high of 375 yesterday!

This weekend I will be sending out a Newsletter on what I think is ahead for the markets as my thesis has evolved with recent economic data and earnings. Powell speaks today so we will have a better idea of what the FED is thinking moving forward. That post is going to be exclusive with no previews so if you do not want to miss it make sure to Subscribe. Starting next week I will be adding swing plans into every single post with updates along the way.

Now lets get into my thoughts for today session!

Events

1100 ET Powell speaks which will be main focus for todays session.