Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

Today was one of the most interesting sessions in terms of market direction. Both indices attempted to push up to the long targets but hit highs with a slow grind downward to the long level. This is where I looked for longs on SPX inside the chat, which saw some upside for nearly 50%, but did not meet my expectations for the session. These positions were cut for a -50% loss as sellers began to step in. Here were the updates inside the chat:

Once the call was cut, I called out a put as the price broke below a key support level in the session. See the update here:

These also did not meet my expectations of a steady sell-off into the close down to the 5299 short target but did see a spike in premiums up to 3.75 for nearly 60%. There was plenty of potential in the session for sellers to capture downside, but this was contained as market makers focused on stop runs of longs and shorts without breaking the end-of-day range where the price settled. Into the close, the price finally broke the lows, but the contracts had already decayed too much, resulting in contained selling that only managed to reach 5320. While we did call out the right direction, too many stop runs prevented us from capitalizing on the opportunity. It was an unfortunate way to wrap up the session, but I'm glad to have stuck to the right side of the market based on structure.

Commodities:

Oil slowed its downward trend toward the short target. The price fluctuated between the long and short levels, similar to the indices. Overall, the only opportunity was overnight (OVN), which is not something we can capitalize on based on our schedule. For tomorrow's session, we have a clear setup similar to today's, with longs above the swing VAH (Value Area High) and shorts below the swing VAH.

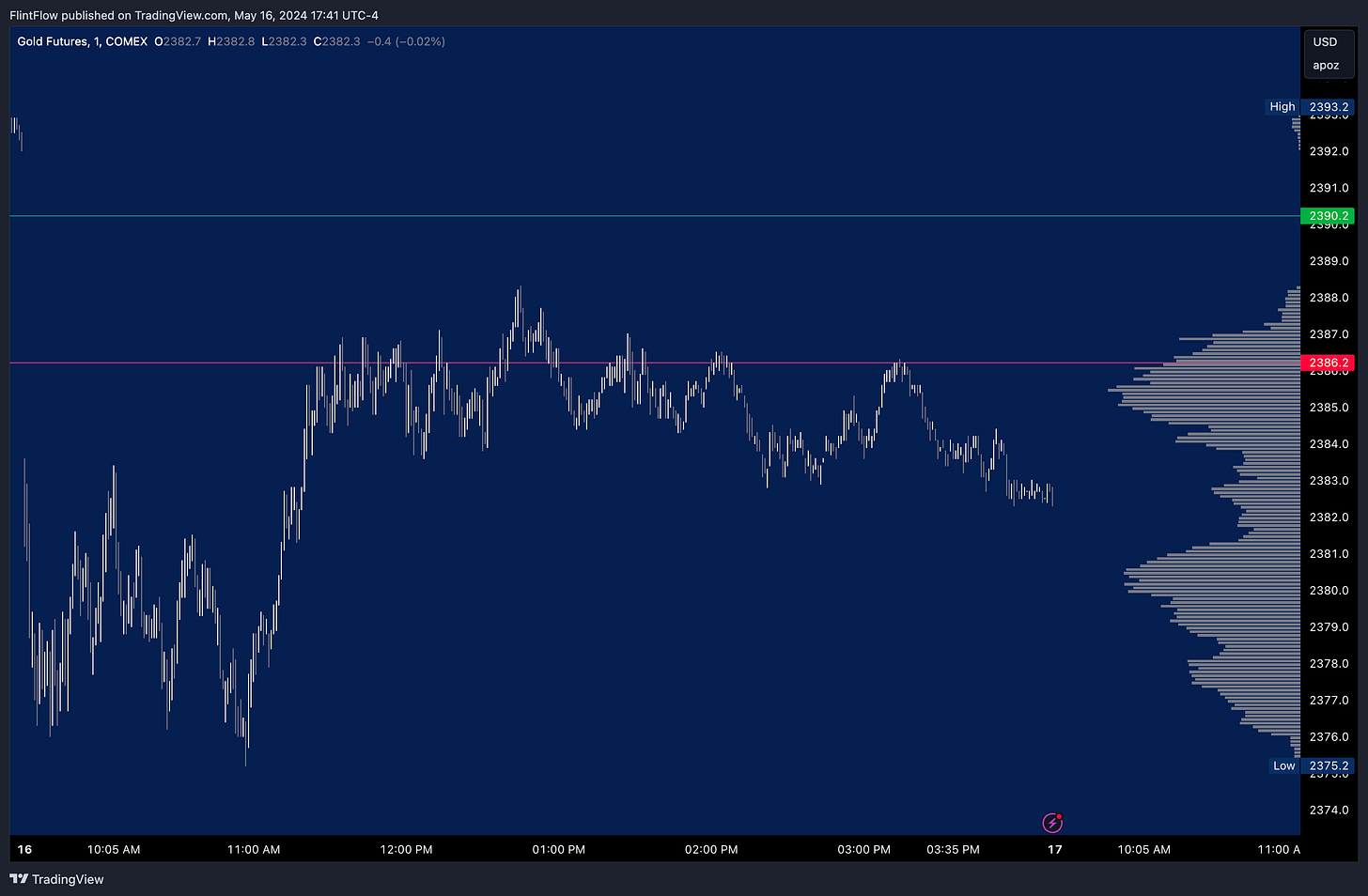

Gold remained below the short level throughout the session, with the sell-off beginning just before the open. Overall, it was a slower session, but all the opportunities were provided directly off the short level.

Stocks:

GE gave back half the gains posted yesterday, but with next week's contracts, there is plenty of time to reach new swing highs. As this rallies, I will update the sections below for the contracts and provide timely alerts in the chat.

MSFT experienced some selling today, but like GE, next week's contracts have more time to see further upside. The price set a high near my 426.33 target. If we see a reclaim of this target, I will send an update in the chat regarding further upside potential.

WMT posted strong earnings, resulting in a sharp spike before the open today. The price rallied through the 62.5 target, which had been posted in the last two sessions leading up to the release. Contracts saw over 200-300% upside by the open today.

DE also posted earnings today but did not meet my expectations of gapping up after the report.

Make sure to show some love by dropping a like if you enjoy reading this post!