Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

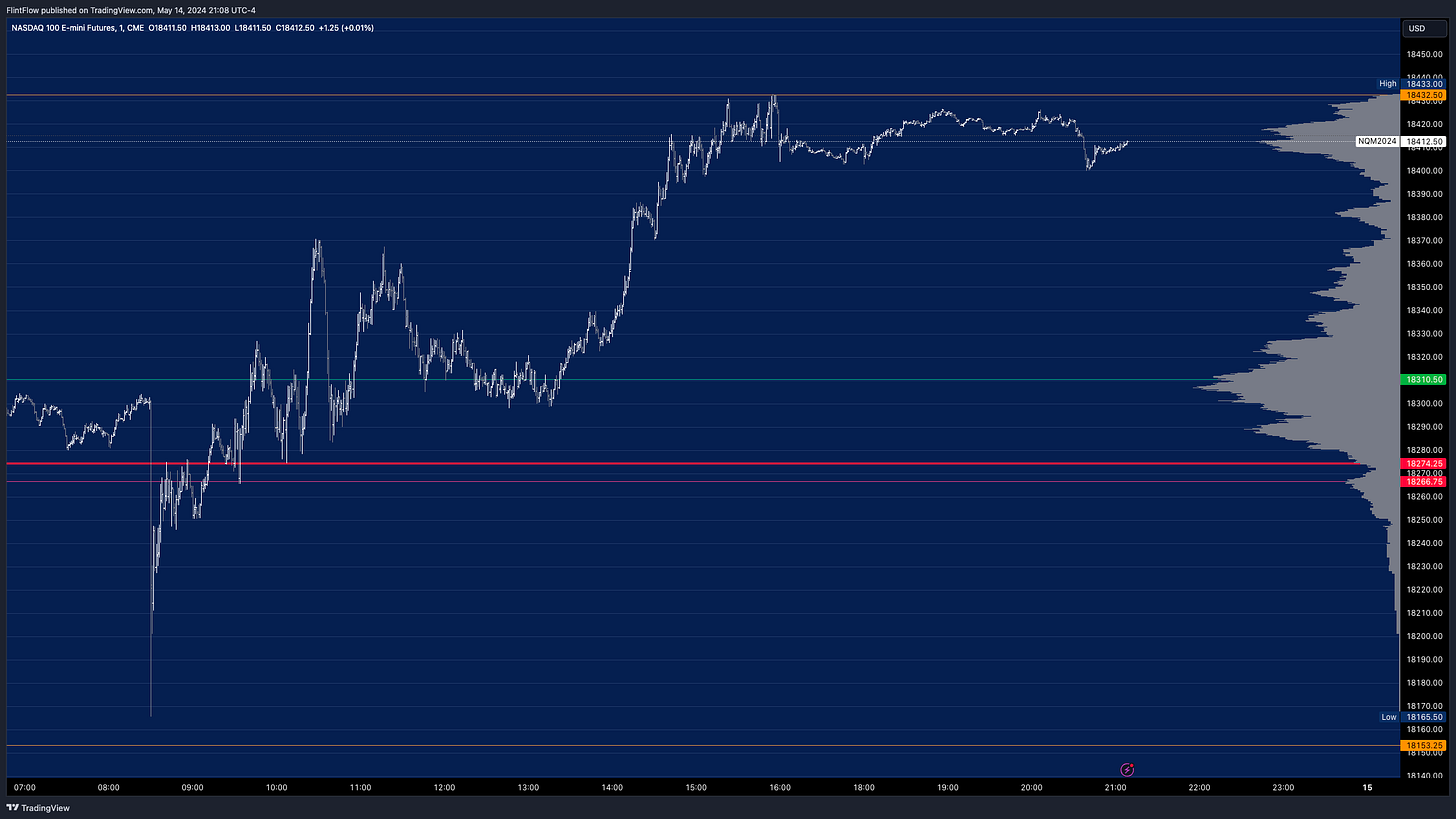

Today's session with the E-mini presented a mixed picture, while the Nasdaq consistently demonstrated strength, holding well above the critical level. The key level was effective, although there was a deceptive dip in selling once the E-mini dropped below the swing's VAH. I had anticipated a retest near the lows following the PPI release, but instead, the price quickly rebounded above the VAH and rallied significantly past the critical level, reaching the long target. When the price approached the VAH, I suggested buying puts, which unfortunately did not yield the expected results. At the peak, there was a solid setup for continued momentum, but I chose to exit as the price lingered too long without spiking. This decision proved advantageous as the price then dropped back to support, reducing the call premiums substantially. The market did experience a brief surge up to 5275, where I again waited for an opportunity with puts, but these too were unsuccessful as the price declined only at the session's close, offering no chance for a profitable trade. Recently, end-of-day (EOD) movements have become more predictable, contrasting sharply with the large swings in 0DTE at the end of each day over the past two weeks. Although I am cautious about this pattern persisting, it's important to recognize that there has been minimal movement in the final hour of the sessions lately. Despite the SPX contracts not performing as expected, individual stocks saw significant movements today, as outlined in last night's analysis. These movements will be further discussed in the stock section below.

Commodities:

Oil once again hit its target, capturing nearly the entire movement from high to low. This consistent performance underscores the asset's predictability and potential for profitable trades.

Gold, on the other hand, showed strength from the long level but fell short of reaching its target. Although it hasn't been as dynamic a mover as oil, gold still adheres to the established long and short levels, providing opportunities for these setups to still work out.

Stocks:

GME reached my target of 50 and maintained its strength today, with the uptrend firmly intact. Contracts highlighted in last night's newsletter surged from 4 to 25, achieving a 500% increase overnight.

AVGO experienced a massive rally in today's session, with indications that there is still considerable room for further growth. Contracts have already appreciated by 270%, moving from 3.7 to 13.8.

MSFT encountered some selling in the previous session but rebounded strongly today, lifting contract prices from 2.29 to 3.15. This recovery showcases the resilience of MSFT's market position.

SMCI is currently moving contrary to the puts outlined last night, which are now down roughly 80%. However, a strong recovery is possible depending on the outcome of tomorrow's CPI report, which could influence market sentiments.

BABA experienced a sharp decline near my target in a single session, primarily due to its earnings release. These contracts soared from 0.9 to 2.67, marking a 200% gain. This demonstrates the volatility and potential profitability associated with earnings-driven movements in the market.

Make sure to show some love by dropping a like if you enjoy reading this post!