Welcome back everyone!

Before we delve into the recap and analysis for tomorrow, I want to inform everyone that the price of this newsletter has increased. However, there's a 10% discount available for those who subscribe using the coupon provided below. This post will be accessible to all readers, allowing you to see what you're missing out on. Please note that current subscribers are already paying a lower price than the new rate, even with the discount, so I do not recommend resubscribing at this higher price.

Back to the basics…

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

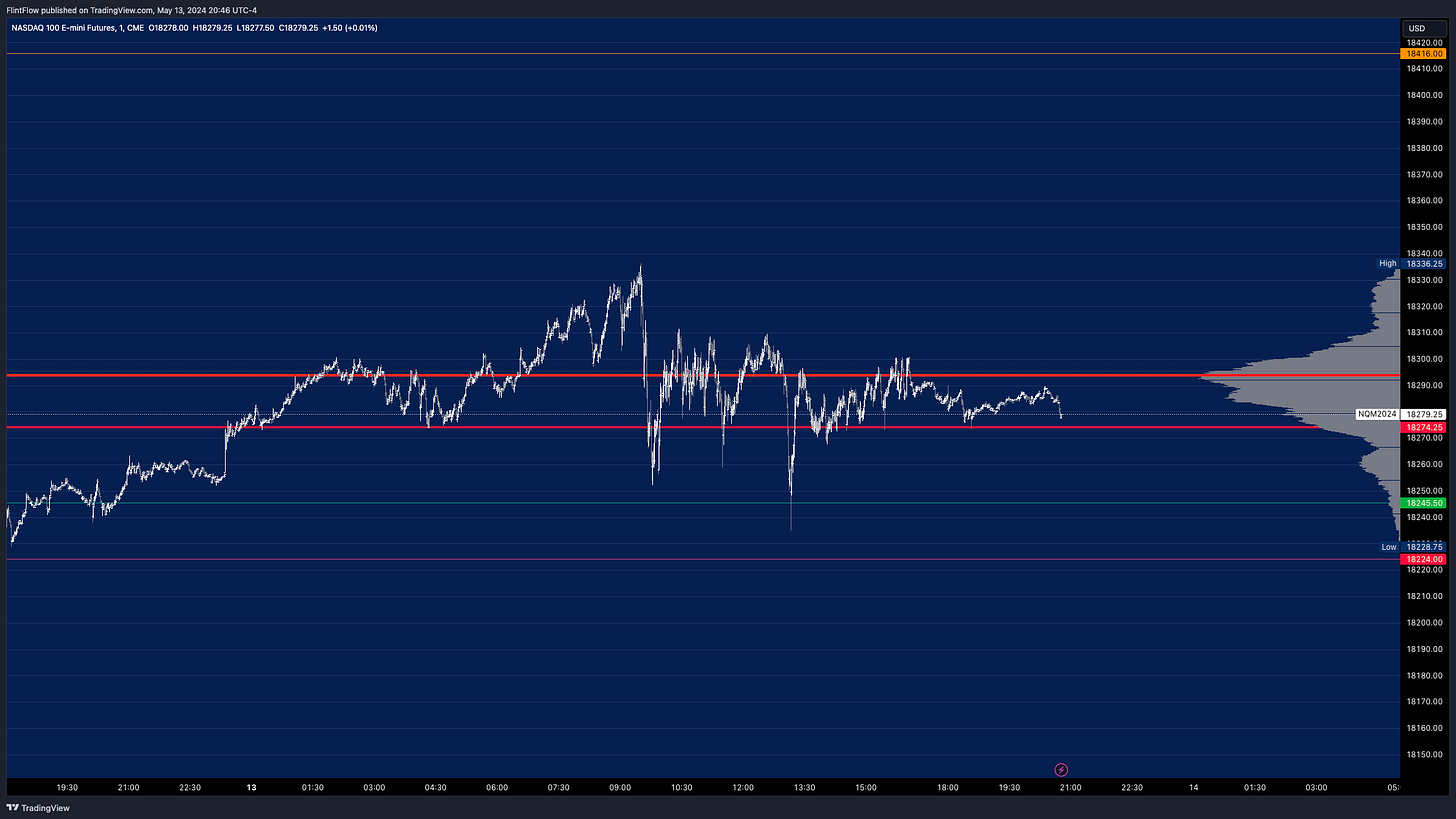

Indices:

Both indices experienced strong rallies before the open but ultimately sold off, eliminating any further upside for the session. In our chat, my thesis suggested that we might see a rebound at the end of the day (EOD), but every spike was sold into as traders and investors adjusted their positions in anticipation of the PPI release tomorrow. This cautious approach reflects the market's attempt to price in potential impacts from the upcoming economic data.

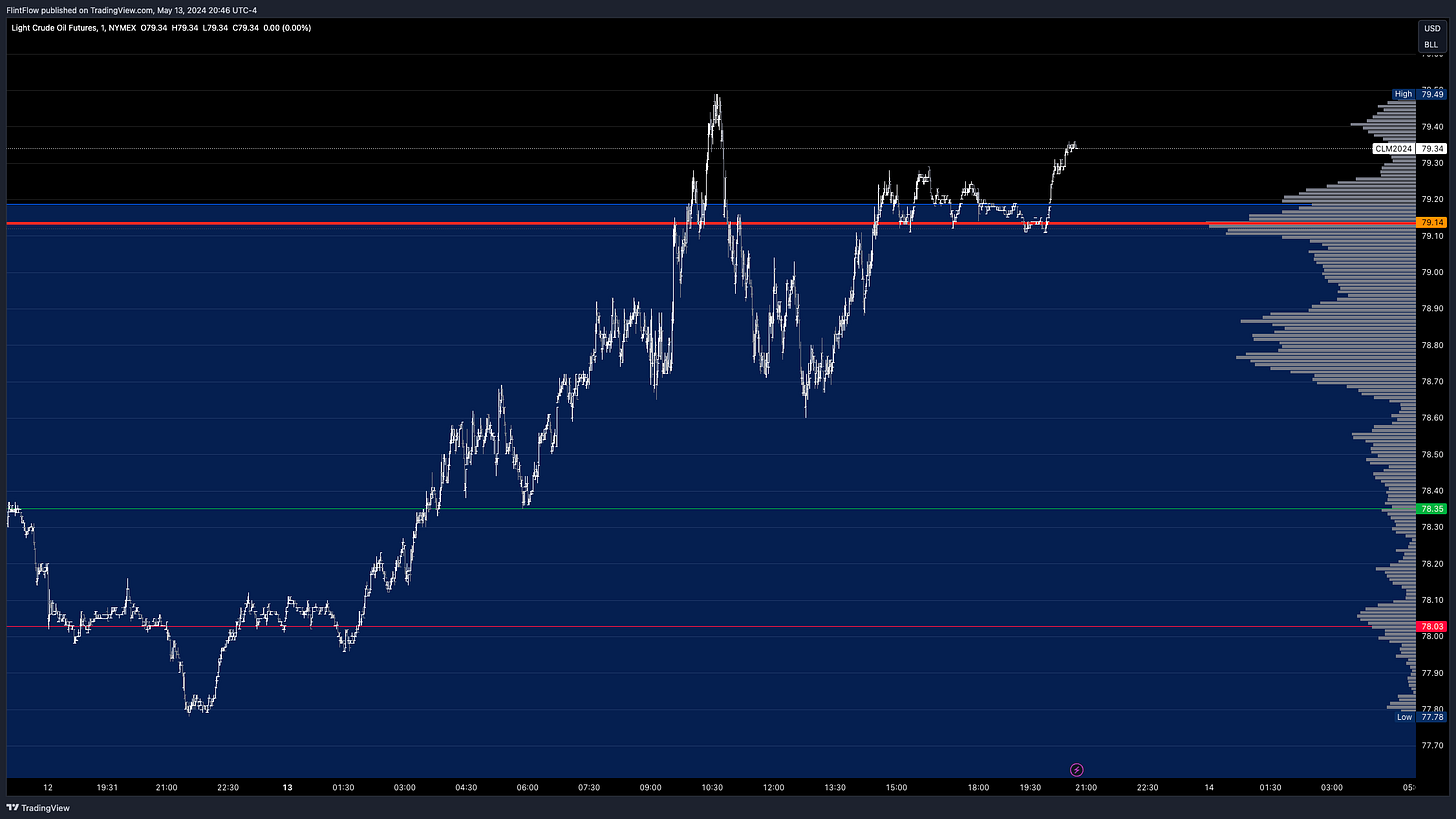

Commodities:

Once again, Oil and Gold exhibited strong movements, targeting key levels. Oil rallied above the long level, spiking the price right up to the long target. There was still momentum left for buyers with an attempt to break above the swing Value Area High (VAH). However, this effort fell apart, leading to selling that drove the price back below the swing VAH.

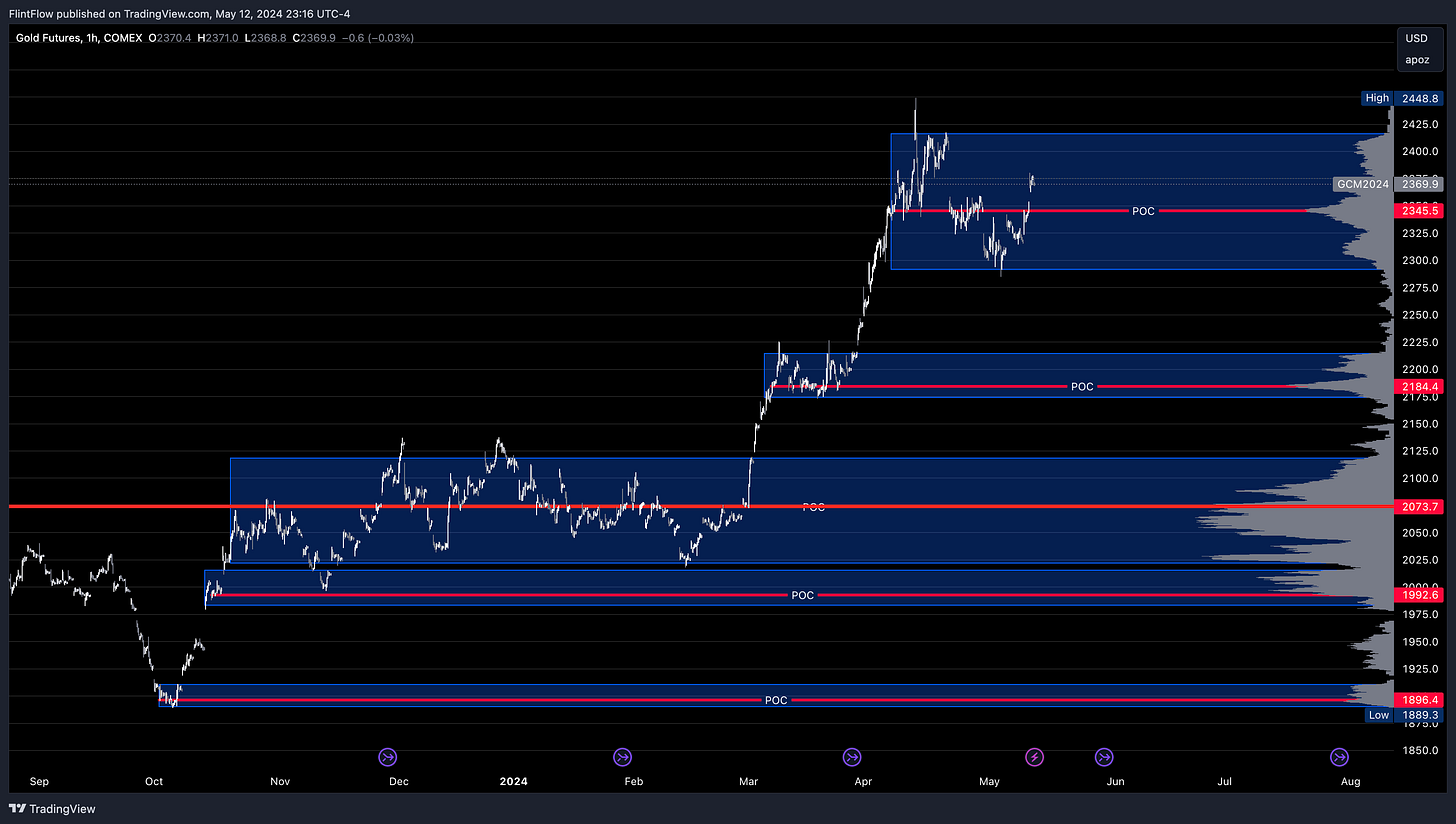

Gold experienced steady selling below the short level, selling right down to the short target, which established the session's low. Additionally, the swing Point of Control (POC) played a crucial role throughout the session, acting as a key support turned into resistance. I have often discussed how magnetic the POC can be and its effectiveness as a target area. Although the short target was below the POC, both areas were pivotal during the session.

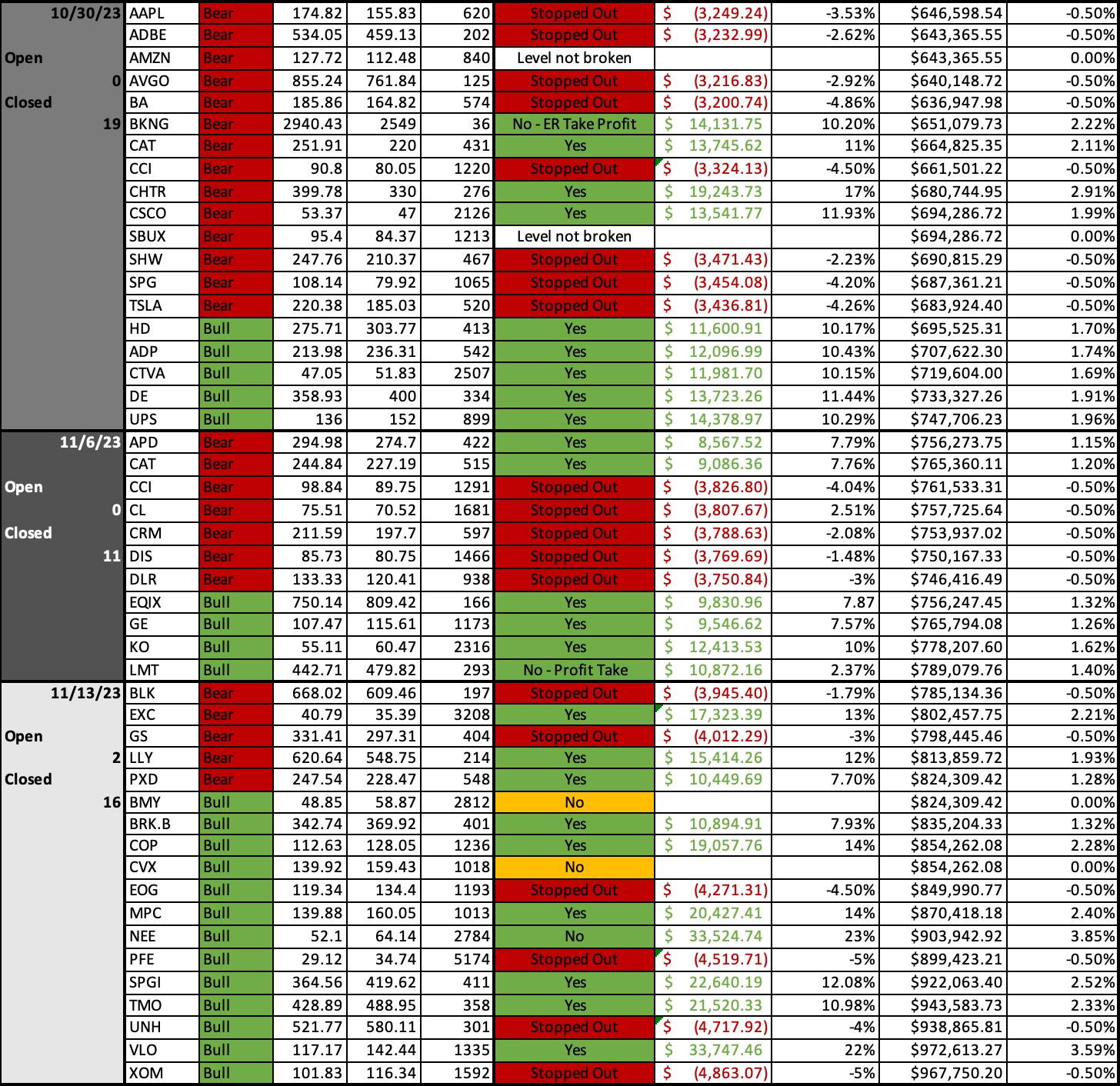

Stocks:

Today in our chat, I highlighted GameStop with a support level at 27.5, which was noted during the session. This support level set the low just before I sent out the notification, triggering a major rally to the upside. The price moved right up to 38 overnight, hitting the high and meeting my intraday expectations. I believe this momentum could continue, potentially reaching the 50 mark tomorrow.

Apple experienced a significant rally right up to the Value Area High (VAH), encountering little to no resistance. This allowed for a continuation of the upward trend right up to the next swing Value Area Low (VAL).

Tesla witnessed a major spike from the long level, resulting in a sharp increase in contracts. All of these large movements were covered in last night’s "Flow State" video and came as no surprise.

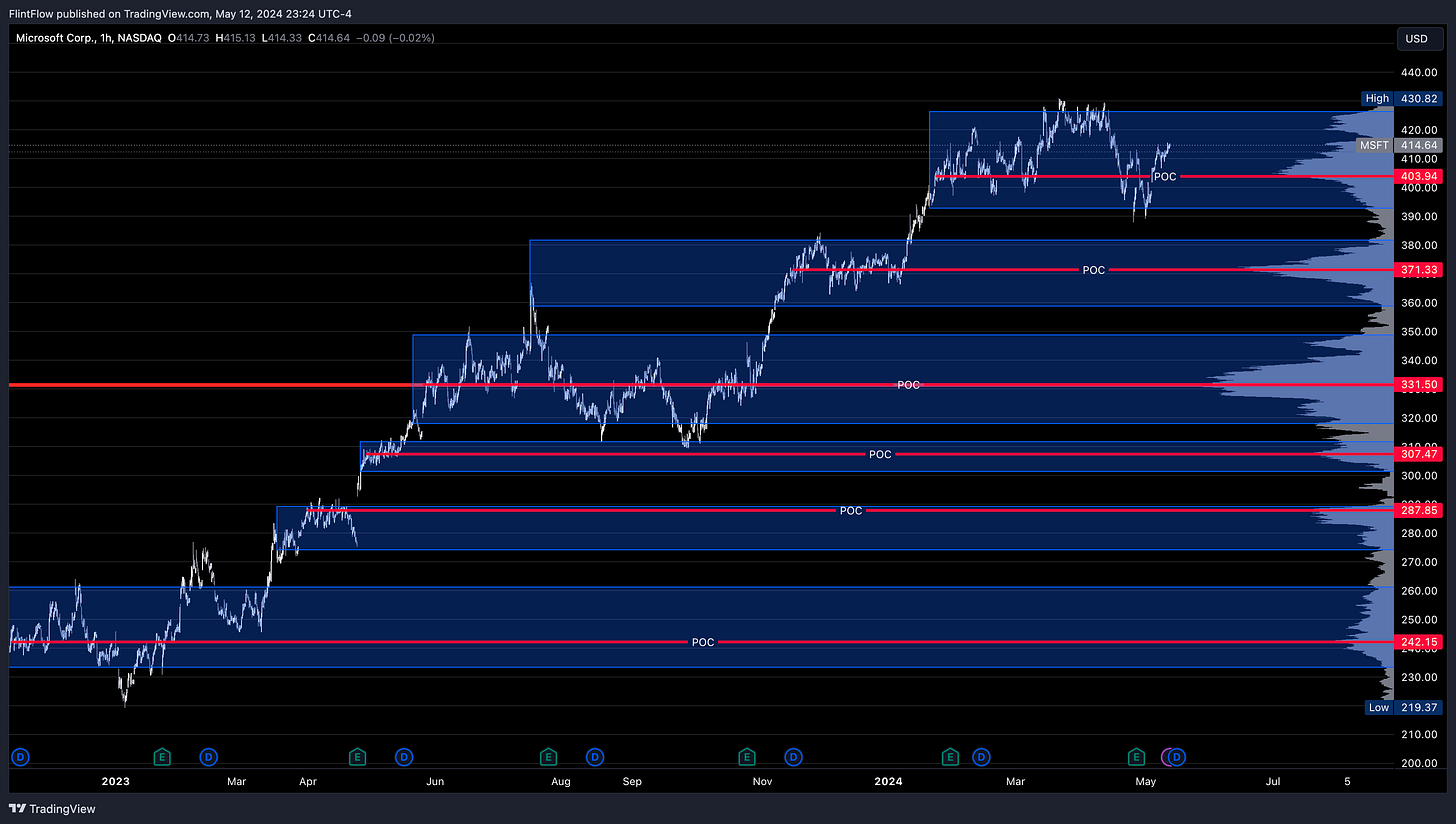

Microsoft saw a strong gap up at the opening but ended up giving back all of its gains and more. Later in the session, as we began to see a bounce, I noted a key intraday support level in chat, which held alongside option contracts. These contracts closed mostly unchanged but saw a nearly 50% increase during today’s session. I anticipate a continuation higher from here, which will likely depend heavily on the upcoming PPI and CPI reports.

Meta, like Microsoft, plummeted right from the short level, leading to a massive sell-off at the open. This demonstrates the effectiveness of the levels identified by Volume Profile.

Make sure to show some love by dropping a like if you enjoy reading this post!

Events

PPI - Overall, this continues to rise, which negatively impacts the overall economy, particularly the CPI report. It is crucial that it remains below 0.2% to prevent further acceleration. We are at a juncture where even minor changes in data can shift perspectives on the overall economy significantly. The current situation may appear stable, but it can quickly spiral out of control; therefore, we must remain adaptable in anticipation of upcoming data releases. While inflation data is of utmost importance, I believe that we can still expect significant movements in the indices based on this PPI report.

Earnings

Tuesday:

HD: Bullish - Target 364.14

Wednesday:

CSCO: Bullish - Target 49.73

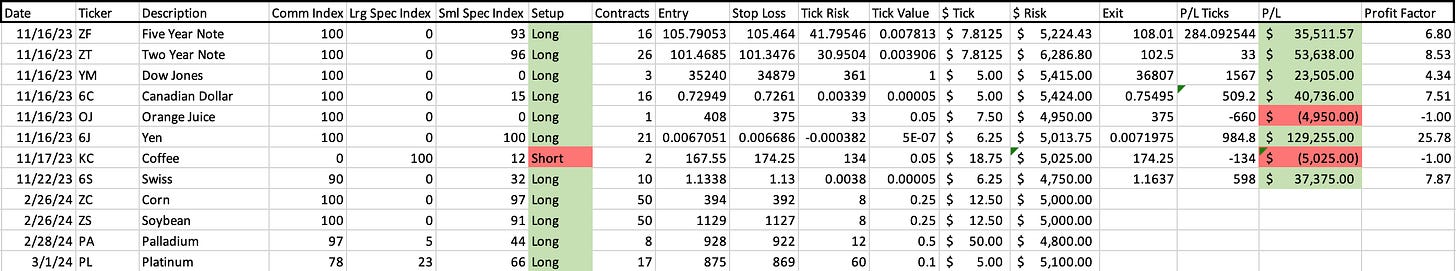

Individual Market Positioning (COT Reports)

Momentum Gallery (Swings)

Long Term (Retirement)

Dollar Cost Averaging (DCA) - SPY

Stay tuned for weekly updates to come!

Futures Value Areas with POCs/HVNs

ES:

3873-4046 / POC 3953

4101-4225 / POC 4139

4258-4334 / POC 4274

4358-4446 / POC 4402

4478-4602 / POC 4513

POC 4659 & 4703

4733-4837 / POC 4812

4867-4932 / POC 4915

4939-4999 / POC 4975

5005-5052 / POC 5015

5132-5243 / POC 5207

NQ:

10799-11667 / POC 10928

11865-12399 / POC 12115

12510-13456 / POC 13061

13611-13990 / POC 13861

14233-14493 / POC 14318

14696-15613 / POC 15337

15071-16551 / POC 15831

16948-17380 / POC 17217

17544-18594 / POC 18274

CL:

69.41-78.85 / POC 73.28

80.93-86.08 / POC 82.66

86.99-90.75 / POC 89.41

GC:

1828-1850 / POC 1834.1

1859-1895 / POC 1885

1922-1976 / POC 1967.2

1982-2012 / POC 1987.5

2024-2073 / POC 2051.7

AAPL:

123.72-135.23 / POC 129.93

147.19-155.16 / POC 152.21

163.19-166.59 / POC 164.83

170.08-179.19 / POC 177.67

180.48-186.02 / POC 182.61

187.47-197.65 / POC 193.04

TSLA:

107.59-132.74 / POC 121.79

154.92-201.66 / POC 185.10

206.40-222.07 / POC 214.68

230.06-278.28 / POC 256.39

NVDA:

111.99-174.15 / POC 131.28

259.88-315.61 / POC 274.89

378.85-505.31 / POC 453.87

POC 541.96 & 615.70

671.43-741.09 / POC 730.36

POC 791.77

MSFT:

233.40-261.30 / POC 242.15

274.15-289.31 / POC 287.85

301.42-311.77 / POC 307.47

318.04-348.78 / POC 331.50

358.79-381.68 / POC 371.33

399.86-412.71 / POC 403.94

AMZN:

88.46-111.19 / POC 102.29

POC 115.14

123.47-148.03 / POC 129.40

POC 153.40

166.67-181.73 / POC 169.92

AMD:

56.45-76.35 / POC 58.01

85.72-123.58 / POC 102.35

133.89-150.13 / POC 138.70

161.94-183.52 / POC 176.51

GOOGL:

86.18-101.47 / POC 94.51

102.95-108.65 / POC 105.27

116.41-125.84 / POC 122.57

128.16-142.51 / POC 130.91

POC 148.84 & 151.79

META:

91.48-149.87 / POC 116.40

169.95-220.43 / POC 213.21

230.17-251.46 / POC 239.28

264.23-339.05 / POC 300.12

POC 394.34

455.84-491.72 / POC 468.61

Weekly + Daily Plan - 5.13.24

These are setups I see from Volume Profile perspective, any trade taken by you is accepting all risk at stake! Always know what is at risk before entering any trade. The purpose of these are to show what a Volume Profile trader is looking at.

ES Long 5249 > 5270 / Short 5239 > 5214

NQ Long 18310 > 18432 / Short 18266 > 18153

GC Long 2347.7 > 2375.1 / Short 2334.2 > 2308.5

CL Long 79.35 > 80.59 / Short 79.03 > 77.90

Stock levels are being restructured to emphasize weekly swings rather than intraday setups. Consequently, the focus will shift to futures intraday setups accompanied by weekly stock levels. That being said, I will now concentrate on stocks that I believe are poised for significant movements, rather than maintaining a static list of stocks on my radar. There is plenty of opportunity being missed by focusing solely on the same daily stocks; while they have been effective, I believe it is not the best use of this newsletter, in my opinion. This is particularly relevant as many subscribers are able to day trade, but a larger portion cannot stay at their desks all day to manage trades. I would greatly appreciate any feedback you have on this approach.

The information below will include support/resistance levels, targets, and the related contracts. Depending on how the contracts are positioned and how the week unfolds, I will consider introducing other contracts to roll into to give these setups more time to develop. Of course, you could opt to use longer-dated contracts for lower risk and potentially lower rewards—this is purely a personal preference depending on what suits your trading comfort. Extending the contracts by a week or two is what I have in mind.

ALL OF THESE WILL BE UPDATED THROUGHOUT THE WEEK IN CHAT.

GME

Support: VAL - 27.5

Target: 50

Contract: 35 Call 5/17 @ 4.68

SMCI

Resistance: 835

Target: 720

Contract: 750 Put 5/17 @ 8.2

BABA

Resistance: 88

Target: 74

Contract: 80 Put 5/17 @ 0.95

AVGO

Support: 1240

Target: 1600

Contract: 1400 Call 5/17 @ 3.7

What was already called out in chat this week:

MSFT - Called out in chat today.

Support: 411.36

Target: 426.33

Contract: 417.5 Call 5/17 @ 2.29 & 417.5 Call 5/24 @ 4.5

-Flint

General Risk Disclosure: Trading in the stock market involves substantial risk and is not suitable for every investor. The valuation of stocks may fluctuate, and as a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of stock trading means that small market movements will have a proportionally larger impact on your traded funds, and this can work against you as well as for you.

No Guarantee of Accuracy: The information provided in this newsletter is obtained from sources believed to be reliable and accurate; however, Flint Flow does not guarantee its accuracy or completeness. The views, opinions, and analyses expressed herein are provided as general market commentary and do not constitute investment advice.

No Investment Recommendations or Professional Advice: Flint Flow is not a registered investment advisor or broker-dealer. The content provided in this newsletter is for informational purposes only and should not be construed as investment advice. It does not constitute an offer or solicitation to buy or sell any securities or to adopt any investment strategy. Any decisions made based upon the information provided in this newsletter are the sole responsibility of the reader. We recommend that you seek advice from a qualified professional advisor before making any investment decisions.

Past Performance Not Indicative of Future Results: Past performance of a security or market is not necessarily indicative of future trends. Historical data should not be relied upon as a prediction of future market movements.

Regulatory Compliance: Flint Flow complies with all applicable laws and regulations, including those set forth by the U.S. Securities and Exchange Commission (SEC). We are committed to maintaining the highest standards of integrity and professionalism in our relationship with you, our reader.

Conflicts of Interest: Flint Flow and its staff may hold positions in the securities mentioned in this newsletter. These positions can change at any time.

Use of the Newsletter: The information provided in this newsletter is intended solely for the personal, non-commercial use of its subscribers. Redistribution of this newsletter in any form is prohibited without the express written consent of Flint Flow.