Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

The E-mini was the only index of the two to show strength in today's session. The tech sector was generally weak, which weighed down the Nasdaq for nearly the entire session. The main move on the Nasdaq originated from the short level, and subsequently, it experienced choppy price action for the remainder of the session. On the E-mini side, the price was able to hold above the long level, successfully achieving the long target by the close. I also highlighted an option towards the end of the session that, unfortunately, did not work out as the price took too long to rally. However, it did meet my expectation of 5243 in the last minute. Overall, it was an excellent session as the futures presented plenty of opportunities right from the opening bell.

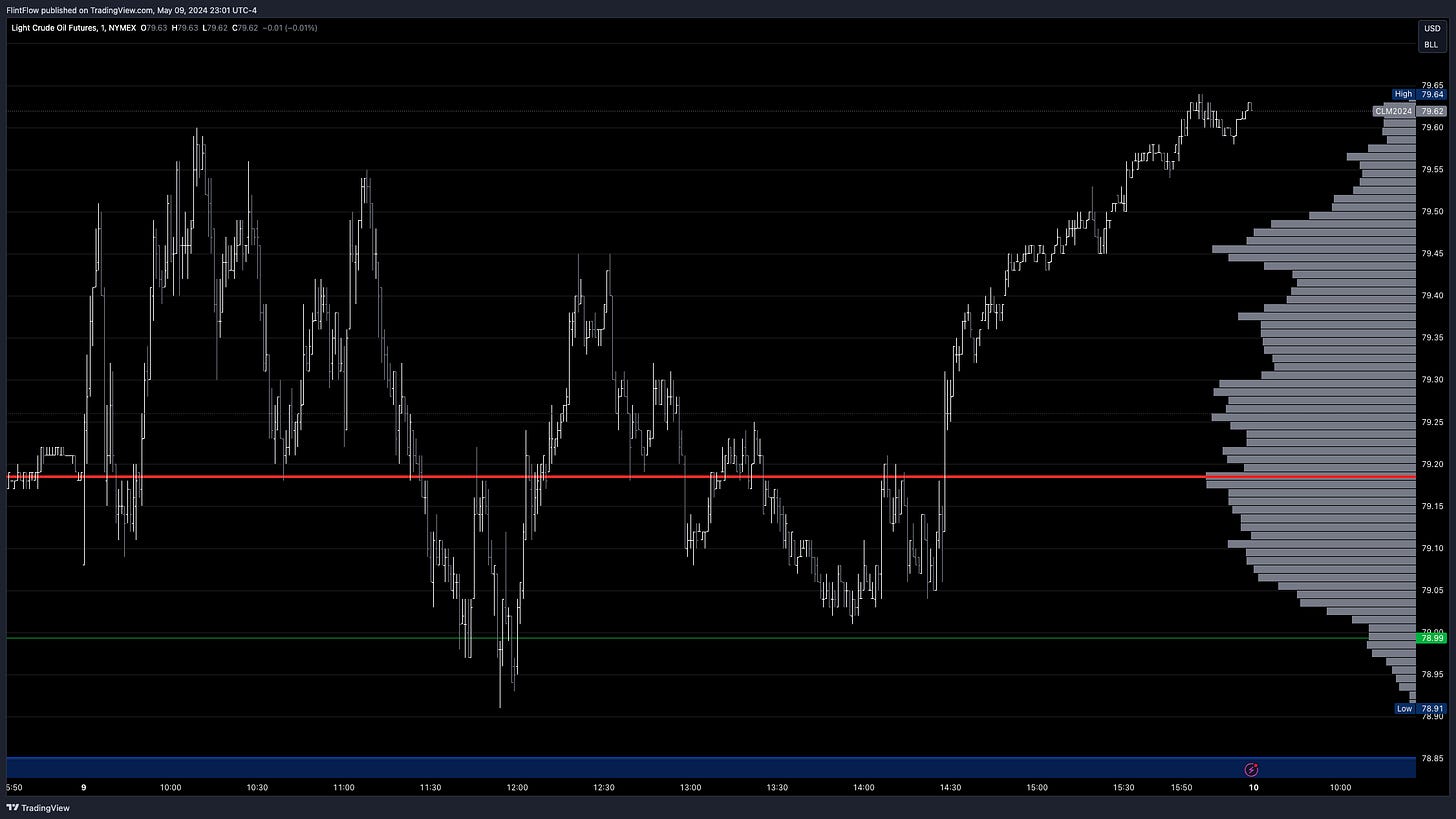

Commodities:

Oil remained above the long level throughout the session but fell just short of the long target. There were two strong rallies above the long level that resulted in favorable moves for us. This session, like others before it, demonstrated how the levels dictate the direction for the session.

Gold completely exceeded my expectations with a massive rally above the long level. The price swiftly broke through the long target, yielding a net gain of 32 handles on the upside. This impressive performance highlights the volatile nature of gold and its potential for rapid gains in favorable market conditions.

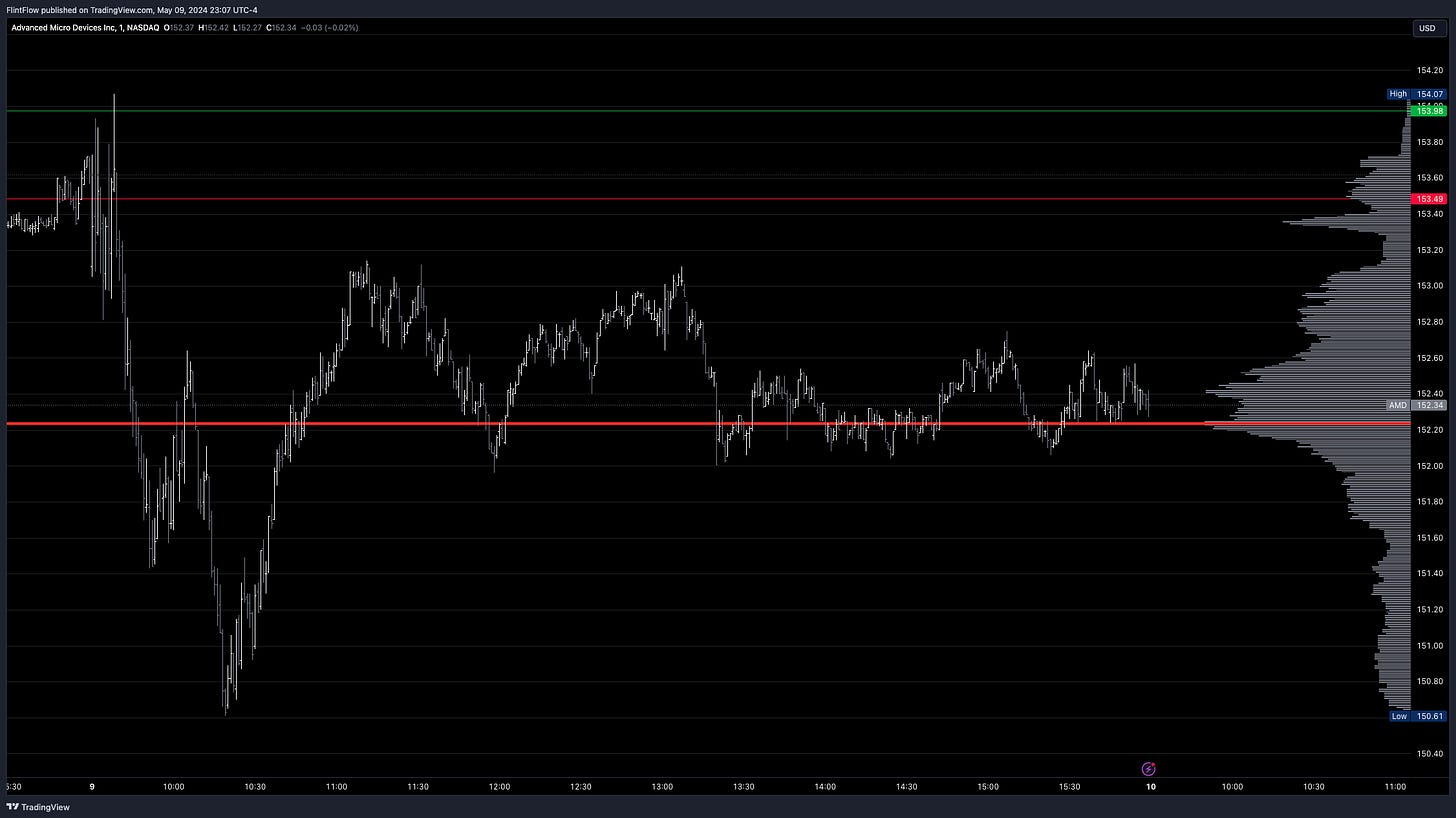

Stocks:

Out of all the stocks today, AAPL and AMZN were the only ones that demonstrated strength from the previous session's close. Both stocks closed above their long levels, which triggered strong rallies. AAPL closed stronger, finishing at the high of the day (HOD), while AMZN also saw a strong rally but sold off into the close. No options were called out after these stocks rallied above the long levels. I do think these stocks could see continued strength into tomorrow's session.

On the other hand, GOOGL, TSLA, NVDA, and AMD all experienced significant declines, falling below the short levels, which offered plenty of trading opportunities during the session. When posting the levels inside the daily plan, they usually manifest early on rather than later in the session. The options mentioned in the chat are typically setups that develop during the day and align with the intraday levels about 50% of the time. At the opening bell, it is crucial to pay close attention to these levels, as they are what tend to dictate early session activity and can lead to substantial moves in one direction.

Make sure to show some love by dropping a like if you enjoy reading this post!