Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

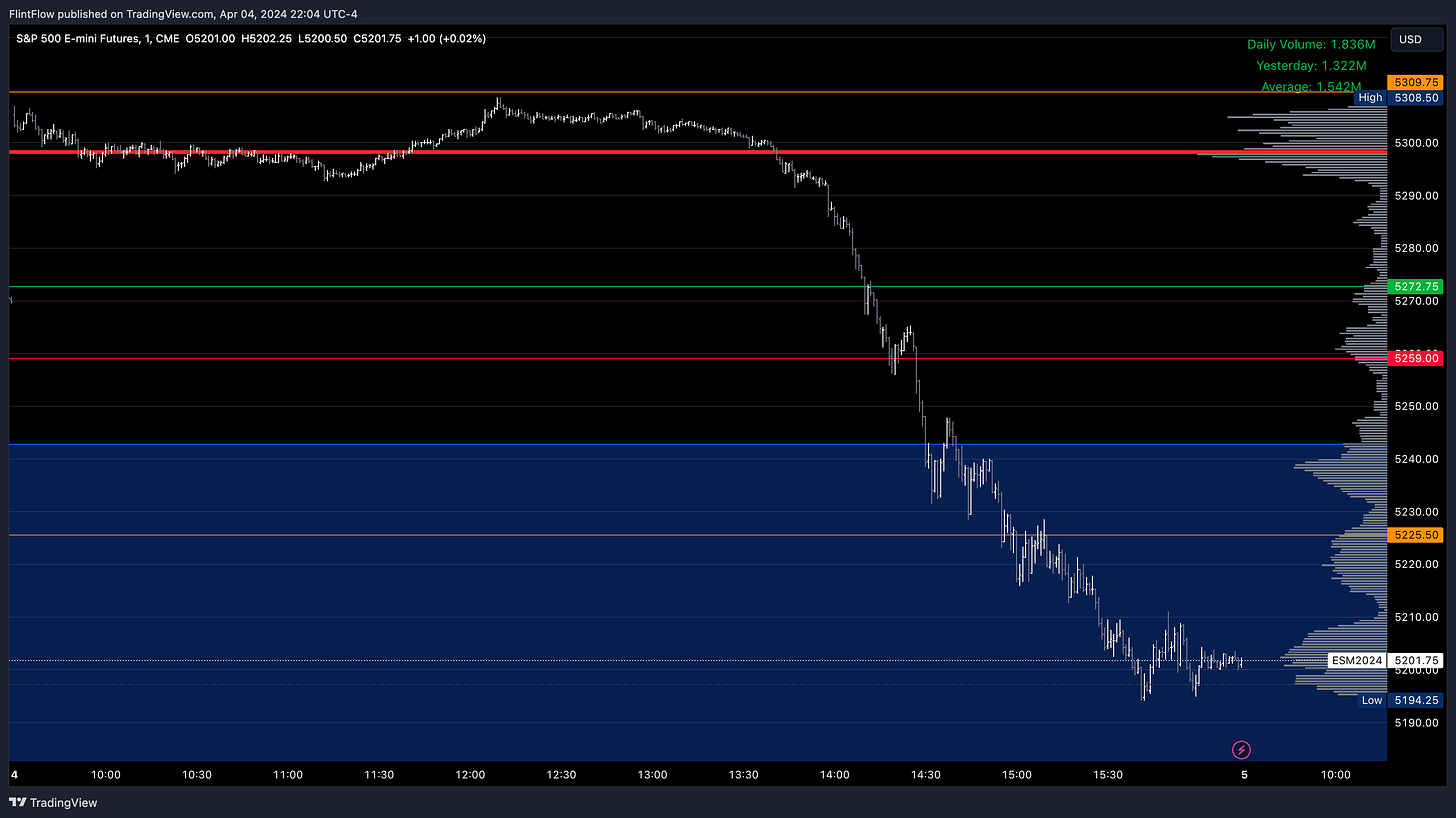

Today was one for the books as both indices rallied up to their long targets before experiencing a significant sell-off towards the close. Although the short targets were initially conservative, the selling pressure intensified after reaching the highs set by the long targets. This downturn presented opportunities, particularly for weaker stocks such as AMD, which I identified as a prime candidate for downside in today's session.

Overall, the levels on the indices were nearly picture-perfect. We managed to capitalize on all the volatility for long positions and most of the volatility for shorts.

Commodities:

Oil once again performed exactly as I anticipated in last night's newsletter. Prices were poised to break above the swing value area high and make a decisive move through the LVN. Although initially struggling within the LVN, we witnessed a rally persisting into the upper value area. Subsequently, prices encountered resistance in the upper value area and consolidated within the LVN, establishing value in this zone. The long target emerged as a pivotal resistance that later transformed into support during the session.

Contrary to oil's clarity, gold exhibited volatility fluctuating between the long and short levels. It even experienced some selling pressure alongside the indices, yet it managed to maintain relative strength, especially considering the significant downturn observed in the Emini and Nasdaq. Many attribute this sell-off to geopolitical tensions surrounding NATO and Ukraine, but I hold a different perspective. If these issues were the sole cause, gold would likely be reaching new all-time highs. Such claims were primarily founded on oil's behavior, which was already entrenched in an exceptionally strong uptrend.

While I acknowledge the importance of geopolitical tensions, I firmly believe they weren't the primary catalyst for today's selling session.

Stocks:

The stock recap predominantly revolves around the observation that the weakest stocks experienced the most pronounced weakness, while the strongest stocks demonstrated resilience amidst the selling pressure on the indices. I have highlighted two pivotal stocks exemplifying each scenario: META emerged as one of the strongest performers, exhibiting minimal selling activity today, whereas AMD, identified as the weakest, faced significant selling pressure.

Consistently adhering to these fundamental principles can help investors sidestep recklessness and achieve a higher risk-reward ratio, along with an improved win rate. The surge in contracts for AMD this week, skyrocketing over 1000% following an update on X, underscores the significance of these strategies. Anticipating further downside not only for the remainder of this week but also for the next, I have already observed prices declining to my initial target of 164 for this week. Tomorrow, I will provide updates on my expectations for additional downside potential in the final session of the week. Stay tuned for further insights.

Make sure to show some love by dropping a like if you enjoy reading this post!