Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

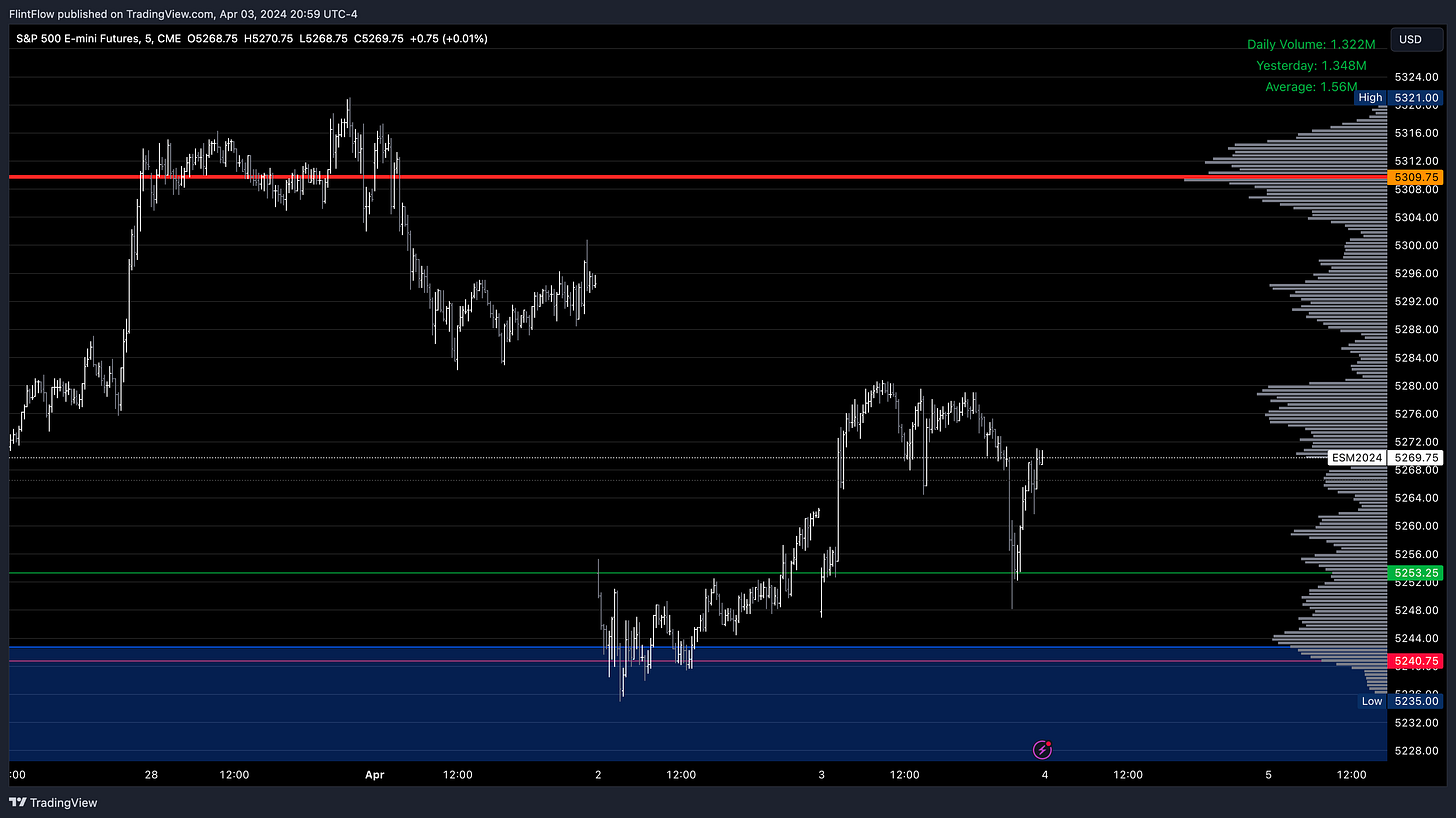

Indices:

The Emini wasted no time in today's session, initiating a strong spike from the 5253 long level, resulting in a 27-handle upside. Despite major events occurring today, overall volatility remained relatively subdued. The Services PMI exhibited weakness compared to the previous release, although it still resides within expansionary territory.

In contrast, the Nasdaq displayed robust upside movement. However, structurally, it still lacks the momentum necessary for a breakthrough to the All-Time High (ATH). As many of you are aware, the Nasdaq has recently faced more challenges than the Emini, experiencing significant outflows in the tech sector. Until this situation resolves and prices align with the Emini, it's unlikely we'll witness a strong surge in highs. The time to heavily focus on long positions will emerge when the tech sector rebounds. Until then, anticipate limited volatility.

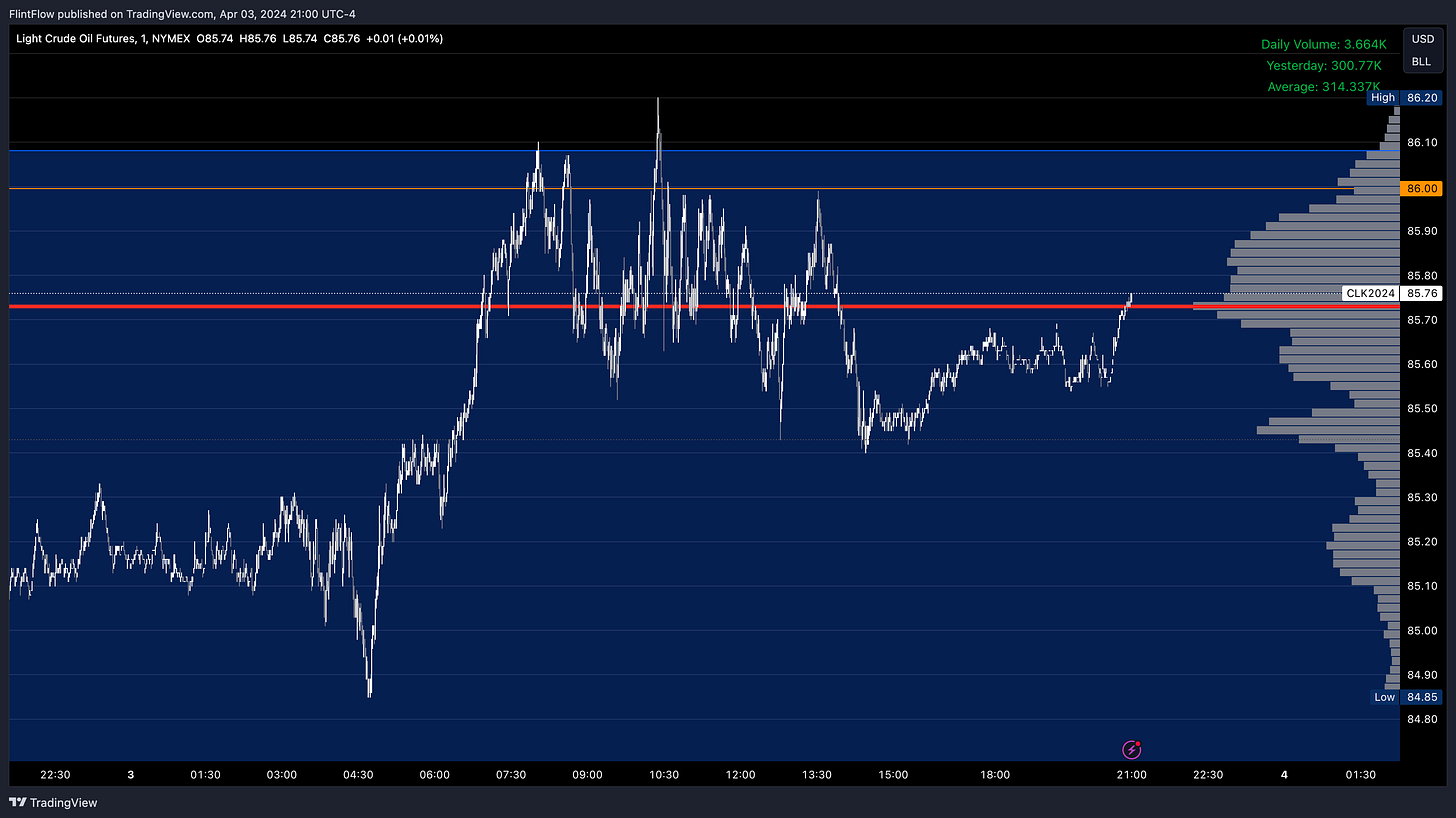

Commodities:

Oil once again demonstrated strength, continuing its rally up to the long target, which then became a significant resistance level throughout the session. This target was strategically chosen as it lay just below the swing VAH (Value Area High). VAH serves as a crucial resistance point where sellers are most active, while the Value Area Low (VAL) attracts the highest concentration of buyers.

Looking ahead, it will be crucial to observe whether buyers can overcome this VAH. I believe there's a good chance this will occur by the end of the week, if not as soon as tomorrow.

Shifting our attention to Gold, we observed a 31-handle rally from the 2290 long level. This level also served as a pivotal support, with minimal downside movement observed before the price surged to new highs, marking a strong trend day.

Stocks:

As I mentioned yesterday, META. was a pivotal stock that continued its upward trajectory as anticipated. It emerged as the standout performer in today's session, experiencing another robust rally following yesterday's bounce from lows. Remarkably, even the late-session selling pressure on the indices failed to suppress its momentum.

The weakness in the tech sector was evident in today's session, with both indices showing resilience while individual stocks struggled to recover from the previous session's sell-off. Patience is paramount as we await these stocks to reclaim their highs, potentially igniting another strong rally. Long positions should maintain their focus on META., while closely monitoring vulnerable stocks such as AAPL, TSLA, MSFT, and NVDA for further signs of weakness.

Make sure to show some love by dropping a like if you enjoy reading this post!