Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

E-mini and Nasdaq exhibited significant strength above the long-term levels before transitioning to a sell-off later in the session, eventually breaking through the short-term level. Overnight, prices dropped to the short targets, resulting in a significant sell-off, as anticipated, with META's earnings positively influencing our position. Currently, we are retreating from the highs, reversing the robust rally from the last two sessions. More earnings are expected this week, with a key focus on Microsoft (MSFT), which is scheduled to report after the market closes tomorrow.

Commodities:

Oil experienced limited volatility in the session, with modest selling occurring below the short-term level. Prices are holding firm as they seek support for a potential upward push.

Gold, on the other hand, faced strong selling pressure again, with a significant drop late in the night, similar to earlier this week. After breaking through the intraday Value Area Low (VAL), gold prices encountered a sharp sell-off and are now attempting to establish a low point. The market is beginning to accumulate volume at these current levels, indicating a possible stabilization.

Stocks:

Stocks experienced significant selling not only during the cash session but also later on, following META's earnings announcement. NVDA dominated the session, but this was not characterized by major selling as the overnight session was strong, leading to a significant gap up. Additionally, today three stocks posted earnings that exceeded my expectations, which is bringing major movements in option premiums for this week's contracts.

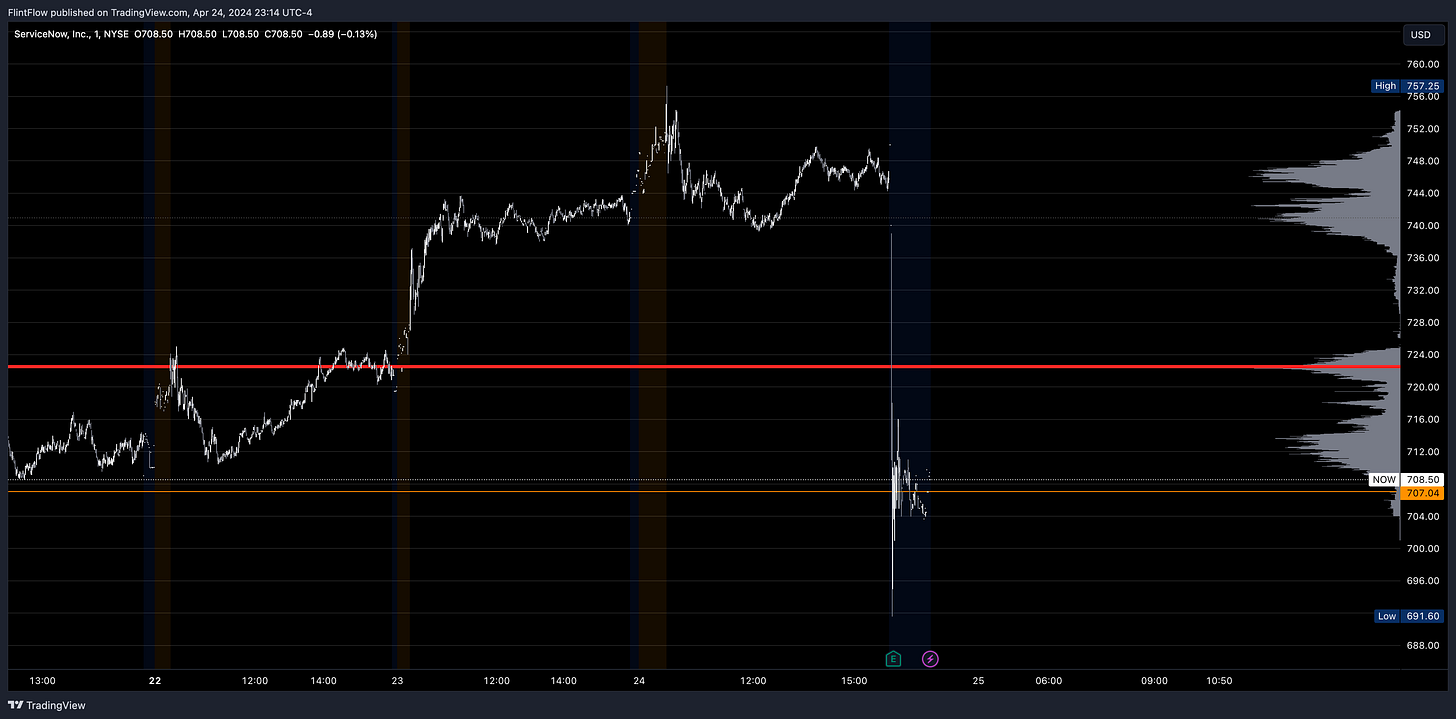

Then we had some major earnings calls that came to be massive moves breaking through the targets.

META: Bearish - Target 457.68

IBM: Bearish - Target 175.02

NOW: Bearish - Target 669.42

Make sure to show some love by dropping a like if you enjoy reading this post!