Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

In today's trading session, both the E-mini and Nasdaq indices found direct support at their respective long levels, which led to sharp rallies reaching precisely their long targets. The E-mini surged from the swing Volume Area Low (VAL) to the Volume Area High (VAH), a movement I detailed in the Flow State video. Meanwhile, the Nasdaq rallied through the Low Volume Node (LVN) and broke above its swing VAL, achieving a strong upside that extended right up to its designated target.

Commodities:

Oil rallied impressively in today's session, reaching my target and posting an increase of over 170 pips. This significant upswing underscores the market's strength rebounding from the recent swing lows, suggesting a potential move to surpass previous highs and exceed the $90 mark. The current momentum indicates robust buying interest at lower price levels, which could be a precursor to sustained upward movement.

Gold maintained its strength above the designated long level but encountered significant resistance at the swing Volume Area Low (VAL). This resistance point effectively capped the upward movement, suggesting a consolidation phase might be imminent.

Stocks:

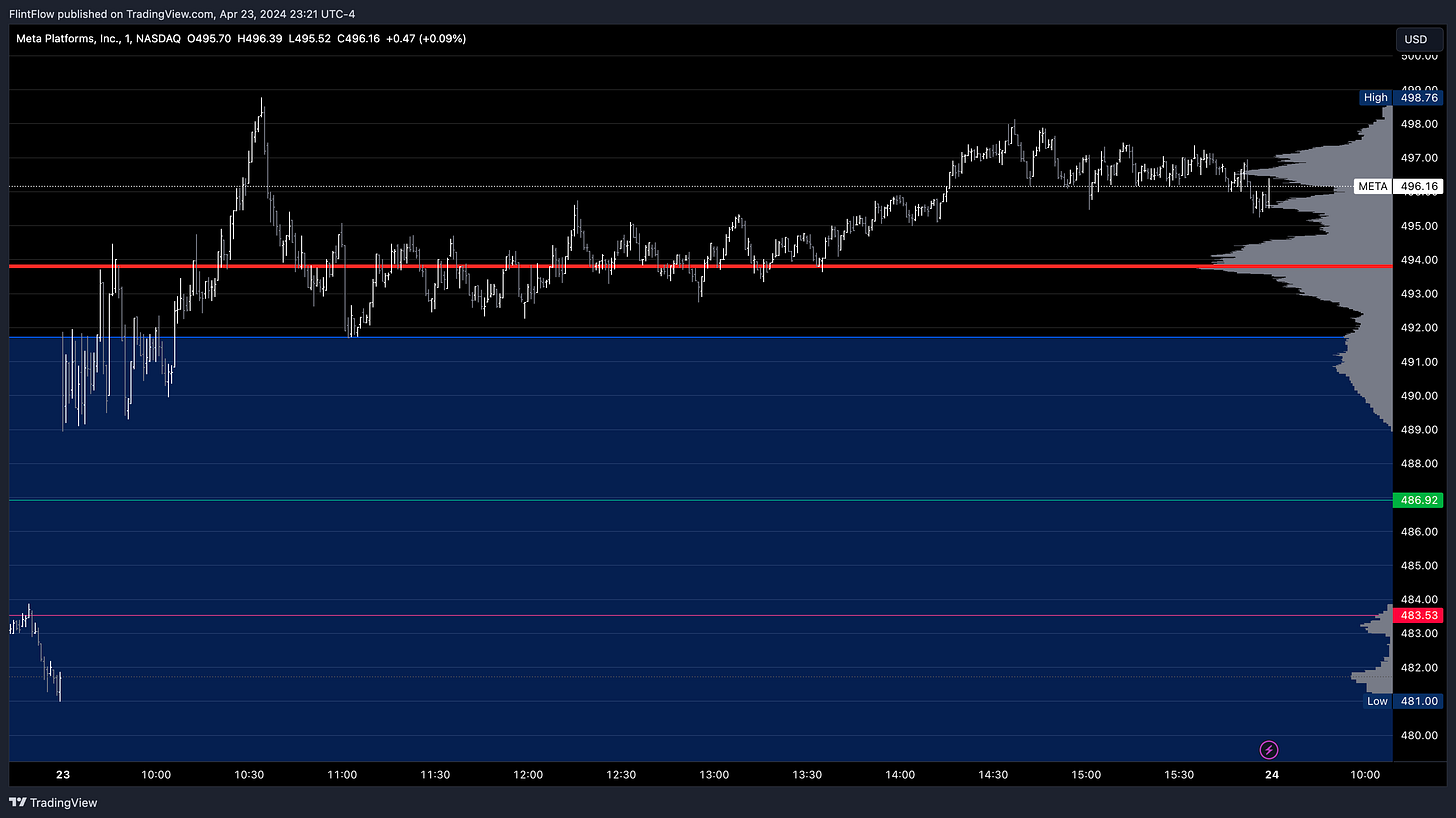

All of the strong stocks in today's session exhibited a similar pattern for the most part, featuring a robust rally in the morning followed by consolidation for the remainder of the day. This pattern aligned with the indices' rally observed throughout the entire session. Stock prices are now breaking above the swing Volume Area Highs (VAHs) that I discussed in the Flow State series and are beginning to show strong upside. I expect this trend to continue as long as we do not fall back below the VAHs, as such a move would reverse the current scenario and potentially lead to more selling down to last week's lows.

A key stock to focus on is Tesla (TSLA), which experienced a sharp rally post-earnings release, contrary to my expectations. The company posted disappointing results, failing to meet both street and my expectations. Moving forward, I anticipate we might see selling pressure on Tesla as long as the price falls below tomorrow's short level, signaling a bearish turn.

Make sure to show some love by dropping a like if you enjoy reading this post!