Good morning traders!

Yesterdays session was slow but once again guided from going negative on first two trades to now making nearly 10x what was lost. If you aren’t inside the telegram, let me fill you in. Emini never traded down to 4143 where I was looking to get long but bounced at 4150s moving all the way through long target 4171. As we began to approach this target I was looking on positioning for short down to 4143. The trend was clear and pushing to the upside but I noted how heavy the resistance was above. VAH has sold us many times and there was nothing new (catalysts) that was leading me to believe this level will break. Here were the two short examples in the morning that BOTH stopped out for only -2 handles each totaling -4 handles to start the session.

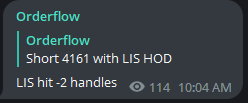

Trade 1: Short 4161 for -2 handles

Trade 2: Short 4163 for -2 handles

Trade 3: Short 4178 (Swung OVN) Now +34 handles

From -4 handles to now +30 handles yet we were caught on wrong side twice! As I said risk reward is key and while session wasn’t in my favor for nearly 6 hours, waiting for the setup at 4178 paid off.

To also note, Fed Beige Book released at 1400 EDT causing an initial spike before descending into the close. This is what the report had to say in summary:

Overall economic activity was little changed in recent weeks. Nine Districts reported either no change or only a slight change in activity this period while three indicated modest growth. Expectations for future growth were mostly unchanged as well; however, two Districts saw outlooks deteriorate. Consumer spending was generally seen as flat to down slightly amid continued reports of moderate price growth. Auto sales remained steady overall, with only a couple of Districts reporting improved sales and inventory levels. Travel and tourism picked up across much of the country this period. Manufacturing activity was widely reported as flat or down even as supply chains continued to improve. Transportation and freight volumes were also flat to down, according to several Districts. On balance, residential real estate sales and new construction activity softened modestly. Nonresidential construction was little changed while sales and leasing activity was generally flat to down. Lending volumes and loan demand generally declined across consumer and business loan types. Several Districts noted that banks tightened lending standards amid increased uncertainty and concerns about liquidity. The majority of Districts reported steady to increasing demand and sales for nonfinancial services. Agriculture conditions were mostly unchanged in recent weeks while some softening was reported in energy markets.Events

-

Earnings

How can a company cut prices over 20% yet profit margin decreases 4%?

Model 3 alone has cut costs of the vehicle by -30% since 2018 yet raw materials and other costs remain high.

What is the industry standard?

Cash increased $217M to $22.4B.

What drove a lower operating margin?

I will make a longer post on TSLA 0.00%↑ Earnings over the weekend, stay tuned!

Value Areas

4095 - 4192 / POC 4177

3880 - 4048 / POC 3951

3823 - 3878 / POC 3862