Welcome back everyone!

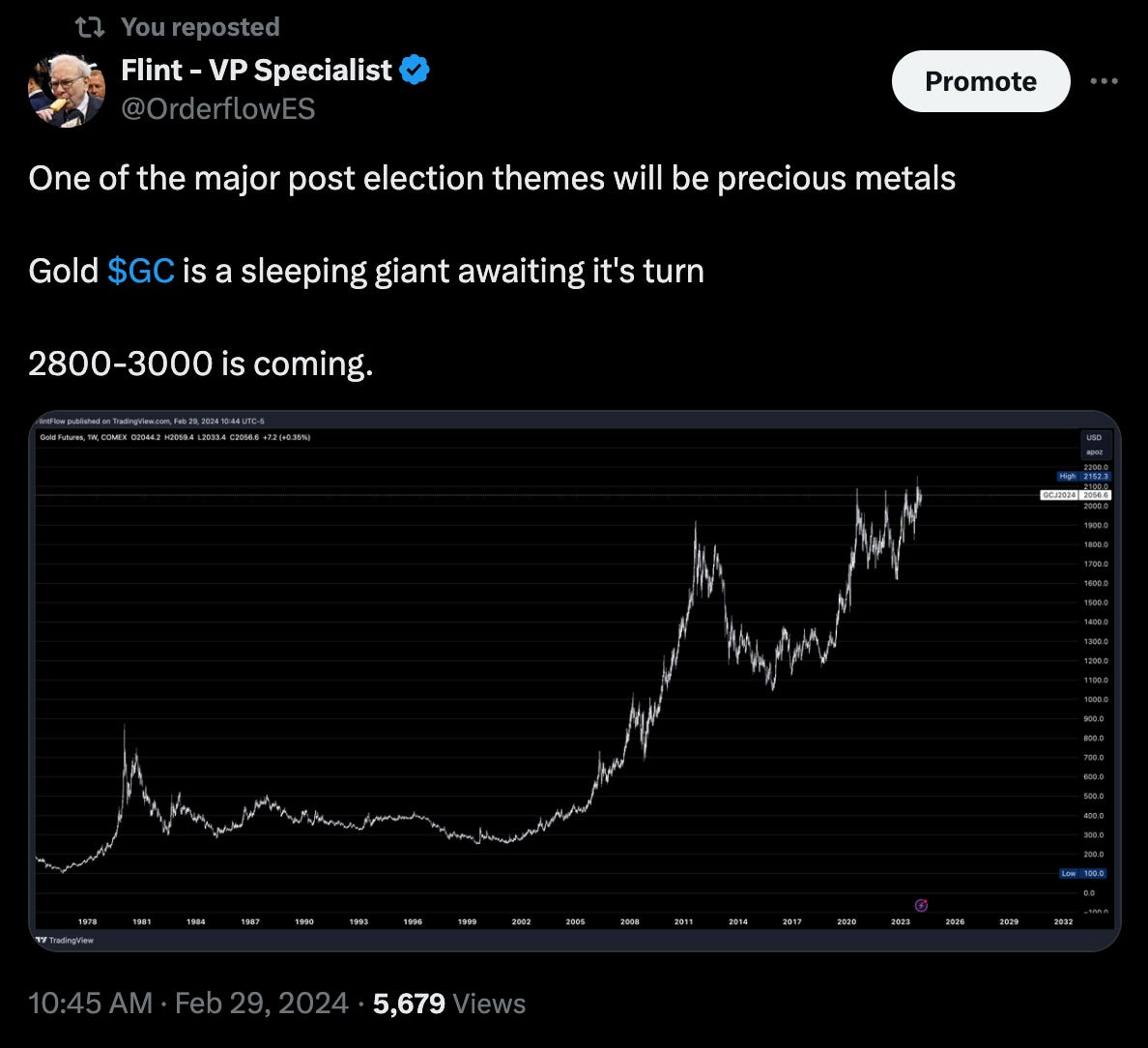

This recap will be concise, yet I would like to share some brief thoughts on today's session and our adept handling of the selling trends over the past few weeks. Despite the challenge of identifying sell signals in a market that predominantly attracts buyers, we have successfully navigated both the ascent and the current descent. The power of volume profiling cannot be overstated, and I urge everyone to focus on understanding how value areas function and the implications of upcoming structural changes and catalysts. Time and again, I've observed that order flow anticipates news events, a point exemplified by the recent surge in the Consumer Price Index and the escalating geopolitical tensions that are now impacting the markets. Both oil and gold are demonstrating resilience, rebounding overnight, while the indices are experiencing significant sell-offs. Apart from these developments, I'm including screenshots of the major warnings issued at market peaks. All these insights are elaborately discussed in the Flow State series, where I dissect the structure in detail across all tickers featured in the newsletter. I recommend everyone revisit the videos from the past few weeks this weekend to fully appreciate how our predictions have materialized. Here are the warnings:

Make sure to show some love by dropping a like if you enjoy reading this post!