Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

Once again, the E-mini and Nasdaq experienced sharp selling, with the Nasdaq displaying significantly more weakness during the session. In last night's video, I discussed the need for the Nasdaq's price to drop further since it has been stronger than the E-mini. Today’s trading confirmed that sellers are actively participating, aiming to drive prices down to the swing VAL to breach the first major area of support. The E-mini has fallen over 100 points from the short level, while the Nasdaq has seen a decline of 451 points from its respective short level. This represents a complete rout of the bulls who were optimistic that easing geopolitical tensions would catalyze a substantial rebound in the indices.

Commodities:

Oil sold off sharply from the $85.91 short level, setting the low of the day at the $84.28 target and capturing the entire range between these levels.

Gold experienced minimal selling below the long level before quickly rising to the $2407 target, achieving 57 points of upside. The price rallied just as I had expected, diverging from the indices which had moved together during the rally for weeks. This indicates a possible shift in investor sentiment, with gold potentially acting as a safe haven amid uncertainties affecting the broader markets.

Stocks:

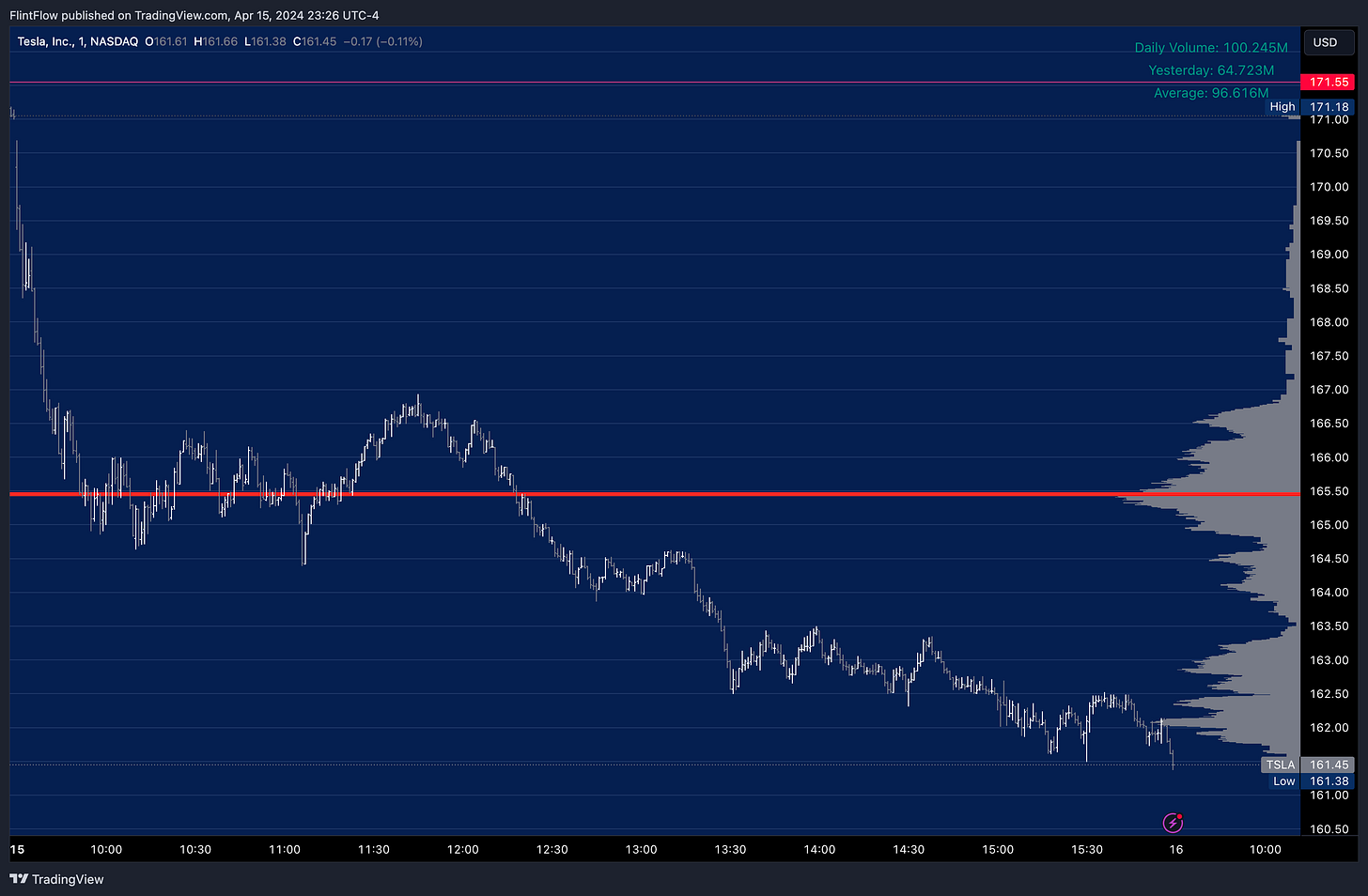

All stocks were weak today, with the main focus on AMD and TSLA, which were highlighted in the Substack chat. Once again, I recommended this week's contracts along with next week's, which offer lower risk but also lower reward. The setups are primed for another downturn, opening up a clear opportunity this week. The significant weakness in the tech sector overall added to the downward pressure on these two stocks. For the rest of the week, we are in an excellent position to let these contracts experience substantial movements. Both setups are nearing a swing LVN that is expected to prompt a quick sell-off, potentially boosting premiums significantly. Make sure to stay tuned to the chat for live coverage of these and other opportunities that I identify during the session.

Make sure to show some love by dropping a like if you enjoy reading this post!