Good morning traders.

Yesterdays session was jam packed with setups which not only were longs but shorts too. Initially CPI was taken as bullish fueling a spike up to 4177. Before I jump into what was called out in the telegram let us first touch on my thoughts on CPI print itself.

All the recent data has pointed to a lower CPI print and a sticky print after these readings would be very bearish. This years Earnings are going to be an absolute blood bath at this current rate.

So two scenarios were in play:

a. Lower CPI print spiking Emini up to 4192 (Bullish)

b. Sticky CPI print with spike to 4177 then sell back down (Bearish)

What was the print?

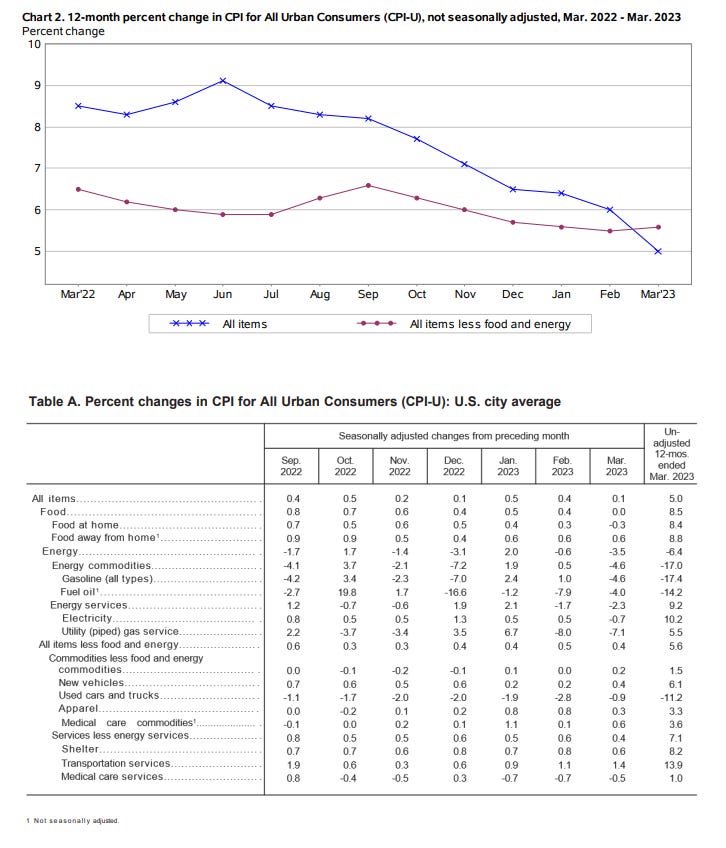

(Chart was pulled from BLS.gov)

Looking at this 0.1 change seems like nothing right now but when you dive into what brought this number it reveals something. Energy! This has come down significantly recently but has setup for another wave of higher prices. Oil which we have been bullish on since 80 is now pushing over 83. With this increase while it must be noted we have seen a continuation decline on Natural Gas as the US strengthens its output will being met with an decrease in demand. This has brought immense selling pressure on NG 0.00%↑ and has helped keep this lid on inflation.

Food costs have yet to make a dent in lowering costs and as rates get near peak and credit conditions tighten more, it will be very hard for average American to get by. Very sad it has come to the point where people are on their last hope by using credit to purchase necessities. This is just wrong!

With this recent print I do not see much hope for the FED until consumer spending takes a major dive. Prices will not come down until consumers are sucked dry and even then prices will not go back to COVID lows. How can we possibly bring prices down when we nearly just increased USD in circulation by 505 since 2020? You can’t.

At this point you now will have to find what prices are the norm and when will we get there. Since this will not be 2% inflation I think a reading around 3.5-4% will indicate a recovering economy.

Supply chain constraints since Ukraine have changed and are still impacted but not even close to when the war started. With that said we will now look to what the other cause in spike of inflation was, COVID. Supply chains are whole again so this is not the issue for prices. So what it? Stimulus. The mass printing we have seen which we we actually started to look much better from recovery side until Ukraine was invaded.

This event has completely flipped the economy upside down and we now are recollecting everything and trying to put it back where it was before. While it will seem like a mess its not. This simply is the massive increase of USD supply.

Once you burn the physical cash then you can bring inflation down which will not happen.

Thoughts now laid out I will dive into yesterdays session along with the updates sent in telegram.

PSA: Telegram includes setups given in Substack Daily Plan + any setups seen during the session. Each setup is provided with Targets, Entry, and LIS( Stop Loss), use examples below as reference.

This update was sent out after CPI released spiking Emini above 4151 long level hitting T1 4177 which also was level I was looking to add swing shorts. 4177 was the high selling down 67 handles. Putting those swings up +67 handles and possibly more into todays session with PPI on deck.

Then shorted break down at 4158 as I liked the profile structure as we began to build of value at highs 4155-4170s. Shorting inside this value for a break below could see a continuation trend into the close so I had high conviction once I saw how weak the market was. This sold down 20 handles before taking out my LIS which was at B/E. Flat.

Got back into the same trade with lower fill down at 4155 but using the same exact setup for this trade. LIS and Targets adjusted and sent out as soon as the setup came up. Right off the bat we saw a 20 handle sell right into T1 4135 locking in 1/3. FOMC minutes came which wit the cushion gave high conviction to hold this for the remainder of the session, exactly what happened.

Wrapping up the session I wasn’t looking to swing contracts OVN and with market nearly trading down to T2 4110 I decided to call it a session 2 minutes before the close at 4115. A 40 handle sell to close out the session!

Swings +67 handles

Longs 4151 +26 handles

Shorts 4158 +0 B/E (unless locked in at +20 handles)

4155 +40 handles

Including swings this brings yesterdays plan up to 133 handles in a single session with our swings ready to soak the rest of this move lower.

If you want to join the Telegram community make sure to use the link in this post.