Welcome back everyone!

Let's kick this off by recapping how the session went for Indices, Commodities, and Stocks, and then move on to what we have in store for tomorrow's session.

Indices:

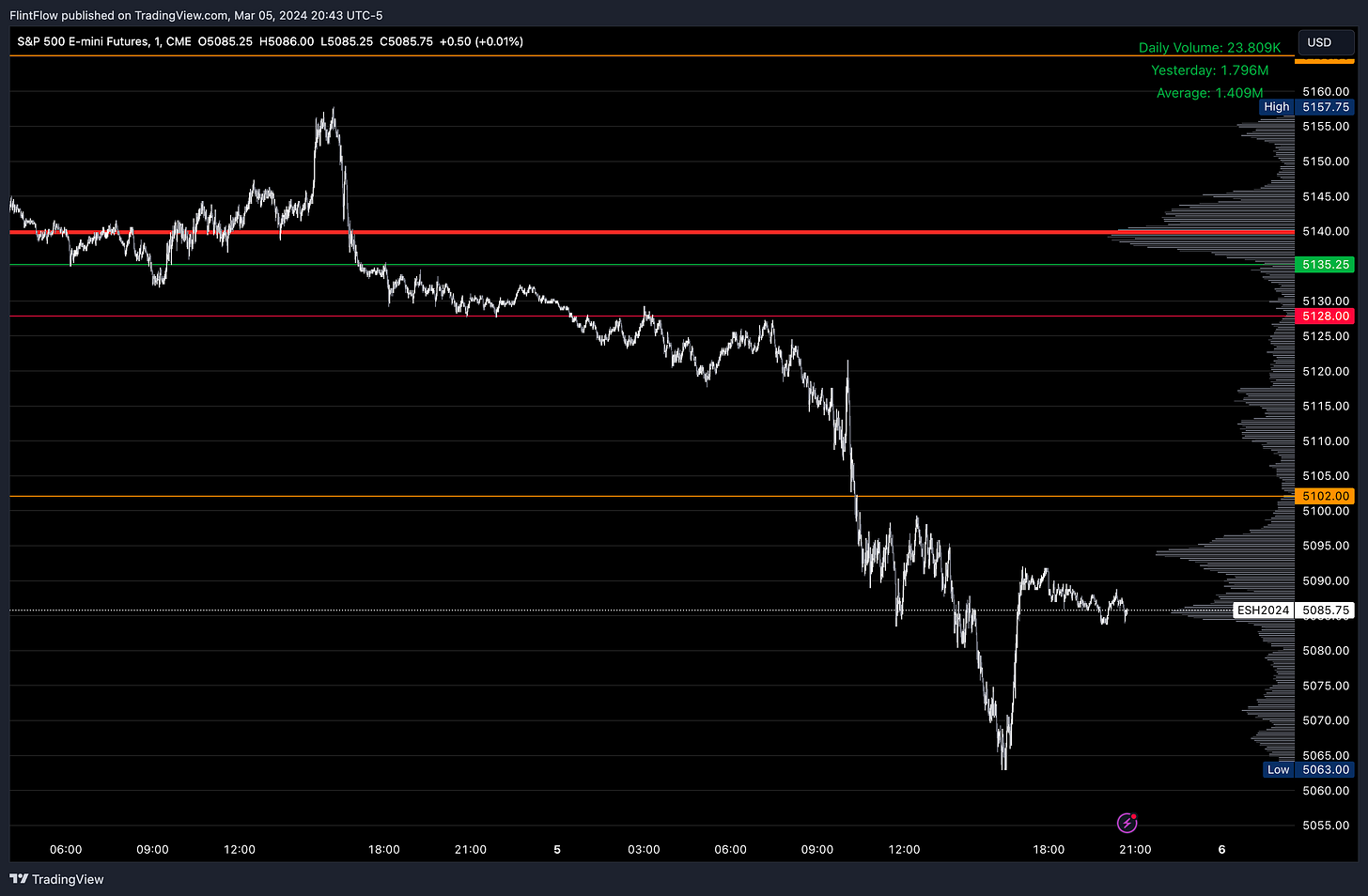

The Emini and Nasdaq both experienced a robust sell-off Overnight (OVN) from the short levels, with the Emini declining from the 5128 level and the Nasdaq from the 18203 level. By the opening bell, both short targets of 5102 and 18102 were reached, with the downtrend persisting. Early in the session, I anticipated a potential bounce on the Emini around the 5090 level, which served as a critical support during Friday's session. Although the price managed a slight rebound and hovered around this level for a few hours, it eventually broke through to the key support at 5070. There was a brief moment when the price dipped lower into the 60s, but this was swiftly bought back up, leading to a rally back up to 5090.

It's worth noting that Powell is set to report to Congress tomorrow and again on Thursday, addressing the health of the economy. Consequently, I anticipate further volatility akin to what we witnessed in today's session. For a comprehensive analysis of what I believe needs to occur to trigger additional selling, please refer to the section below titled "Breaking Down the Profile."

Commodities:

Oil stayed within the swing value area, encountering resistance precisely at the Value Area High (VAH). This aligns with where I placed the short level, although the market managed to hold relatively well in this zone, failing to reach the downside target but still providing a substantial 120 pips decline, with numerous sell-offs originating from this level. Conversely, Gold maintained its bullish momentum, surpassing the 2140 long target and establishing the Overnight Value Node (OVN) low right at the 2122 long level. This trade has proven to be exceptionally profitable on a swing basis, now boasting gains exceeding 150 handles from the initial break at 2000.

Stocks:

Once again, the weak stocks continued to display their vulnerability, a topic I addressed yesterday. I particularly anticipated these stocks to sustain their weakness, especially in response to any selling pressure in the indices, mirroring today's market movement. AAPL, GOOGL, and TSLA persisted in their downward trajectory from the previous close, while MSFT, META, and AMZN also joined the downward trend today. Although weakness crept into the semiconductor sector, it remained relatively stronger compared to all the other stocks listed in the daily plan section.

Make sure to show some love by dropping a like!