Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

Today, we finally witnessed some opportunities emerging as we observed selling into the close on both the Emini and Nasdaq. The Emini exhibited notable weakness in terms of maintaining levels above its long position, resulting in minimal to no upside movement. Conversely, the Nasdaq found support and presented a considerable opportunity for long positions. However, we encountered an issue with the lack of continuation for both buyers and sellers, compounded by insufficient volume. The markets appear indecisive, characterized by minimal participation and limited movement from the opening bell to the closing bell.

Commodities:

Once again, oil has impeccably adhered to the volume profile levels, with prices selling down from the short level and reaching the target, marking the low of the day. Today's volatility remained confined within these levels. Oil has consistently demonstrated its dominance, not only in terms of directional accuracy but also in capturing nearly the entire daily range.

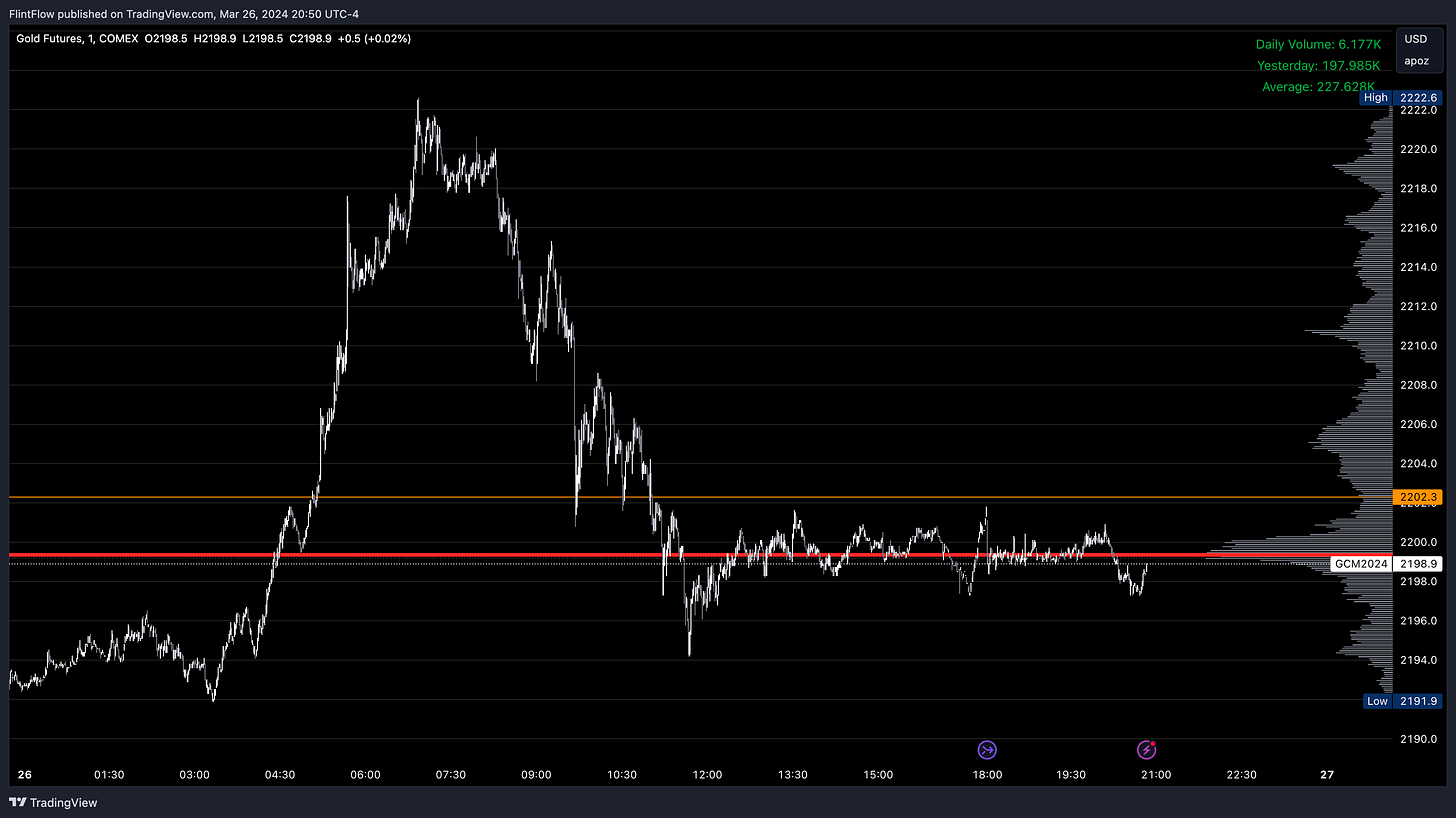

Gold continued its rally from the previous day, gapping up and swiftly surpassing the 2202 target. Prices experienced further extension, soaring above the 2220s, leading to a massive intraday session. The bullish momentum persisted, reflecting significant strength in the market.

Stocks:

AMD, AAPL, MSFT, META, and NVDA all experienced significant selling pressure, favoring short levels and presenting ample opportunities in option contracts. For those concentrating on this week's contracts, some managed to yield returns exceeding 100% on an intraday basis. When swing levels aren't specified, my attention is directed solely towards this week's contracts.

Conversely, TSLA witnessed considerable upside during the session, surging up to 184, although it concluded the session unchanged. It was undeniably an extraordinary day for stock-focused traders, as opposed to those solely tracking indices.

Now let’s move on to the thoughts posted for tomorrows session!