Welcome back everyone!

Let’s kick this off with a recap of todays session and then move on to the video for todays levels.

Indices:

The Emini and Nasdaq both experienced massive rallies today, achieving their long-term targets following the FOMC and Interest Rate Decisions. The Emini surged from the 5246 long level, reaching up to the 5290 target, marking a gain of 44 handles. As anticipated, the uptrend persisted, with no new developments from the Fed. Traders are currently predicting nearly a 70% probability of a rate cut in June, so the situation remains to be seen. Meanwhile, the Nasdaq soared above the 18272 long level, demonstrating a robust rally up to 18494, resulting in a gain of 222 handles.

Commodities:

Oil finally experienced some weakness as it broke below the short level at 82.28. The price reached the short target of 81.49, resulting in a net 79 pips downside movement.

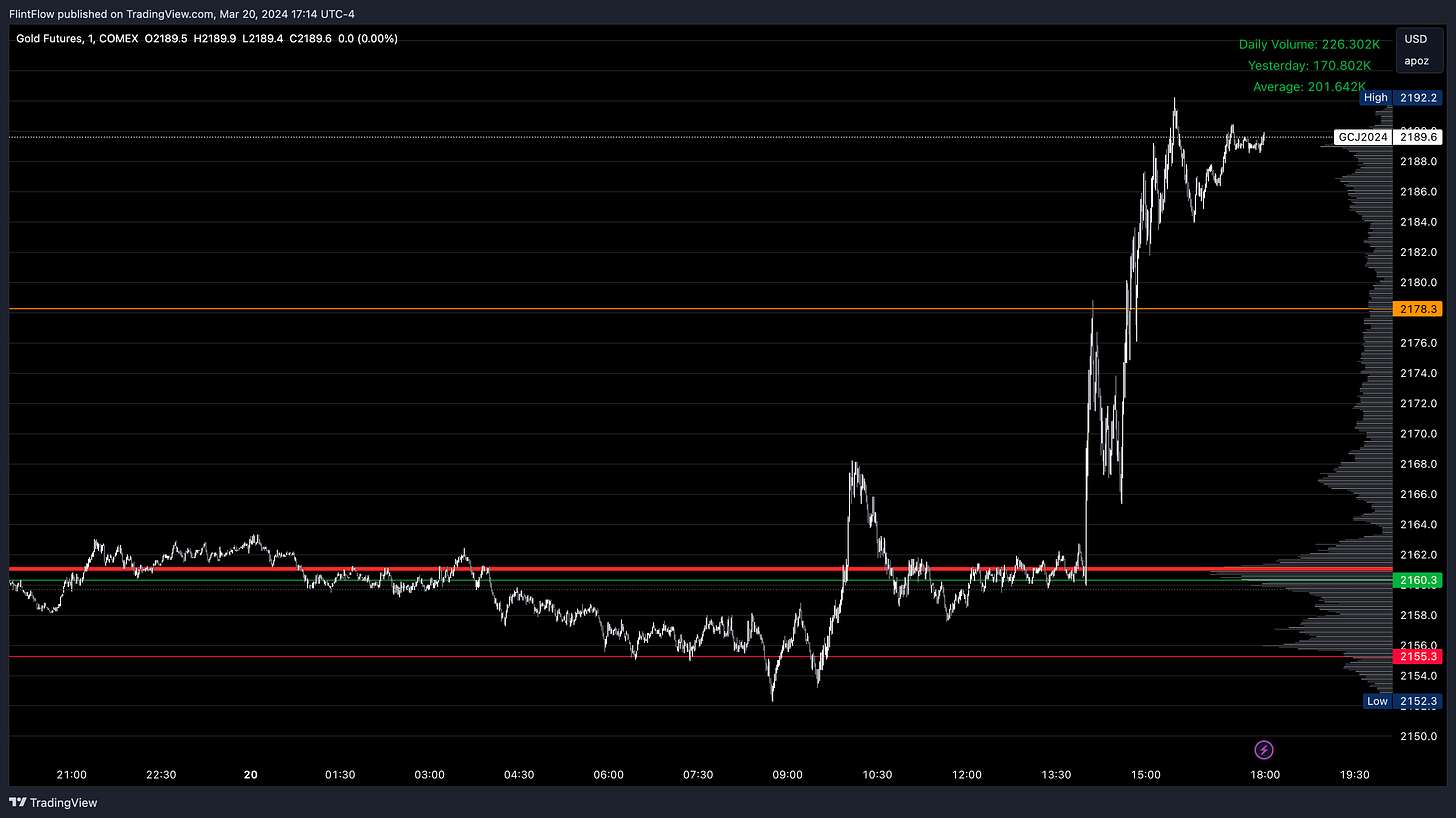

Gold witnessed a sharp rally alongside the indices following the FOMC meeting, propelling it from the 2160 long level to the 2178 long target. This surge was remarkably robust, with the price continuing its upward momentum to reach 2192. In total, 18 handles were captured from the long level to the target, indicating a significant bullish trend.

Stocks:

Once again, AMD has witnessed a sell-off following the significant gap down earlier in the week. Contracts have surged from 2 all the way up to 9. However, the rest of the tech sector experienced robust rallies after the FOMC announcement. Long levels successfully captured all the movements, particularly supported early in the session. Interestingly, the only weak stock today was AMD, the stock I have been focusing on for shorts.

In contrast, Adobe, which I anticipated a day early, has now surged by 40 handles from its lows. This rally confirms my prediction of a bounce following the massive selloff post earnings.

Now let’s move on to the thoughts posted for tomorrows session!