Welcome back everyone!

Yesterday’s levels clearly demonstrate the power of Volume Profile in identifying market positioning. After the market close, we discussed how the Value Area High (VAH) and Value Area Low (VAL) function as critical thresholds where market control shifts between buyers and sellers. For the past two weeks, all downward movements have been met with buying near the VAL. Furthermore, the selling observed at Wednesday’s close originated precisely at the 6908 VAH, not a single tick above it. The expected sell-off materialized, pushing the price nearly all the way down to the 6797 VAL. This resulted in a decline of almost 100 handles from the high. We will now review the posted levels and compare them to the chart.

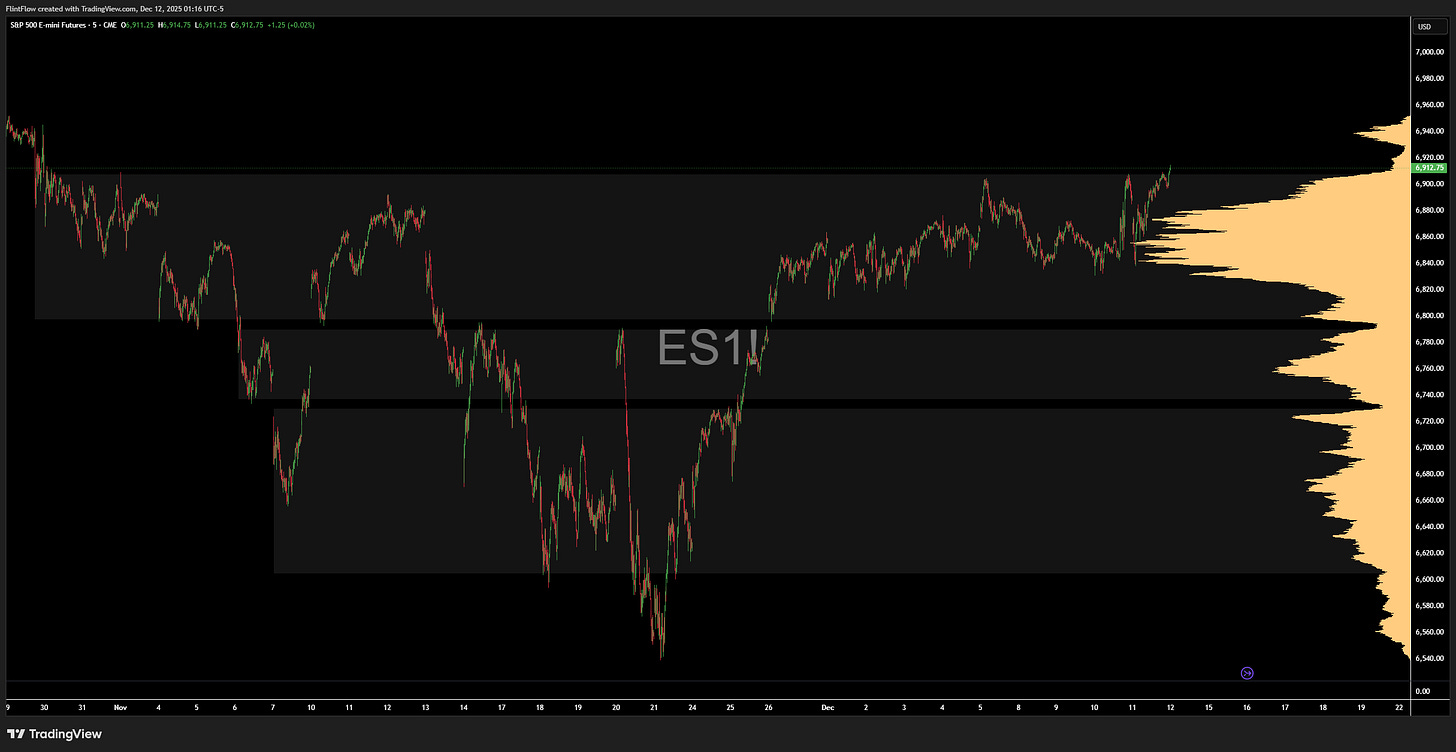

Now let’s take a look at the chart.

First, it is important to note that all value areas will be shown by the gray regions on the ES (S&P) chart. When we establish the levels for tomorrow, the context will become clear.

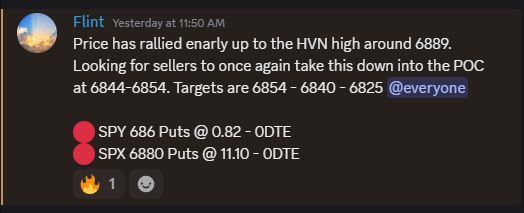

Turning to the cash session, we initially observed a selling phase that reached the lower end of the High Volume Node (HVN) established at the beginning of the week, preceding a subsequent sharp bounce. My thesis was to maintain bearish below the 6908 Value Area High (VAH). Later in the day, this level was breached, resulting in a sharp rally of +21 handles. During the middle of the day, two short signals were triggered. Both came from the 6889 level, which was the upper end of the HVN. On the initial trade, contracts saw a swift 100% rally on both SPY and SPX within a 10 minutes. See the alert below:

Price promptly sold off 20 handles with zero Maximum Adverse Excursion (MAE), making this a highly manageable and swift trade.

Later in the session, the market rebounded toward the previous session’s closing price. I provided the setup for this potentially being a favorable shorting area within the Discord, a discussion that will remain exclusive for subscribers. This presented a 10 handle sell, though it ultimately fell short of the targets. Overall, the session proved to be robust, finishing with a slight gain on the short side. Despite the bearish conviction held the night prior to a 100 handle sell-off, the market finished above the previous session’s highs, and our position remained green.

Before presenting my thoughts on yesterday’s price action, I call on everyone to review the post sent on Wednesday. Today serves as a clear example of expecting a sell-off while simultaneously maintaining a defined level in which shorting is far too risky. This level was the 6908 Value Area High (VAH). Regardless of one’s market expectation, it is imperative to always establish alternative scenarios to avoid being positioned incorrectly.

Moving into tomorrow’s session, we will rely on this same VAH as the primary key level: establishing a short bias below it and a long bias above it.

As the price has returned to all-time highs (ATH), we have zero volume to define targets, as trading has yet to occur at higher prices. Consequently, I will utilize round numbers for setting potential targets. Thus, 6950 and 7000 will be the main targets as we move into the end of the week. In the event of a potential sell below the 6908 VAH, we can then reference the clear support and resistance levels established by the profile over the last two weeks.

Here’s the chart used to pull the levels for the session:

Scenarios for tomorrow

As long as price is able to remain above 6908 VAH, then I expect continuation up to the 6950 highs set back in October.

Upon a sell back below the 6908 VAH, I expect a strong sell back down to the POC at 6856.

The thesis for today’s session is quite straightforward and will be updated throughout the day within the Discord channel. All developments are shared during the session, along with answers to any questions sent by subscribers. The newsletter will remain complimentary until the end of next week; however, I intend to continue offering the first week of every month free of charge to all subscribers. I hope that you are finding these posts valuable. Please feel free to show your appreciation by dropping a like.

Disclaimer

General Risk Disclosure: Trading in the stock market involves substantial risk and is not suitable for every investor. The valuation of stocks may fluctuate, and as a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of stock trading means that small market movements will have a proportionally larger impact on your traded funds, and this can work against you as well as for you.

No Guarantee of Accuracy: The information provided in this newsletter is obtained from sources believed to be reliable and accurate; however, Flint Research does not guarantee its accuracy or completeness. The views, opinions, and analyses expressed herein are provided as general market commentary and do not constitute investment advice.

No Investment Recommendations or Professional Advice: Flint Research is not a registered investment advisor or broker-dealer. The content provided in this newsletter is for informational purposes only and should not be construed as investment advice. It does not constitute an offer or solicitation to buy or sell any securities or to adopt any investment strategy. Any decisions made based upon the information provided in this newsletter are the sole responsibility of the reader. We recommend that you seek advice from a qualified professional advisor before making any investment decisions.

Past Performance Not Indicative of Future Results: Past performance of a security or market is not necessarily indicative of future trends. Historical data should not be relied upon as a prediction of future market movements.

Regulatory Compliance: Flint Research complies with all applicable laws and regulations, including those set forth by the U.S. Securities and Exchange Commission (SEC). We are committed to maintaining the highest standards of integrity and professionalism in our relationship with you, our client.

Conflicts of Interest: Flint Research and its staff may hold positions in the securities mentioned in this newsletter. These positions can change at any time.

Use of the Newsletter: The information provided in this newsletter is intended solely for the personal, non-commercial use of its subscribers. Redistribution of this newsletter in any form is prohibited without the express written consent of Flint Research.

excellent post

excellent intraday calls ! i took and exited with profit