Good evening, readers!

Before we delve into the session recap, I want to emphasize the importance of reading all of my educational posts before diving into this newsletter. Additionally, I have plenty of videos available where I demonstrate live how I map out the levels for the session, offering over 10 hours of educational content through videos alone. To access these videos, simply navigate to the search bar on my page and watch all the videos dated from April 10th, 2023, to May 8th, 2023. These videos can be found within the Daily and Weekly Plans sections.

Here are hyperlinks to all the posts I recommend studying!

Introduction to Volume Profile

There is plenty more educational content in the pipeline, including the highly anticipated "Introduction to Volume Profile Part 2," which is currently in development as we speak! Additionally, I'm working on creating my own macroeconomic models, but as a one-man team, this process does take time. My primary focus is to ensure that readers grasp the intricacies of the data, all while keeping Volume Profile at the forefront. I firmly believe that understanding Volume Profile will revolutionize your approach to market analysis and how you view the markets.

It's worth noting that Volume Profile can be applied to any liquid instrument you wish to trade. I strongly advise against trading illiquid instruments that aren't actively traded by others.

If you have any questions or need further clarification, please don't hesitate to reach out. I welcome all questions, and there's no such thing as a stupid one. Your understanding and success in trading are my top priorities.

The session started off on a choppy note, with the Emini taking some time to push through its highs, whereas the Nasdaq displayed early strength. Eventually, the Emini managed to reach my target of 4298 today, but the Nasdaq fell just short, missing the mark by a mere 4 points, stopping at 14959. Despite some earlier session turbulence that saw price action breaking through both long and short levels, these key levels played a crucial role in defining the overall rally.

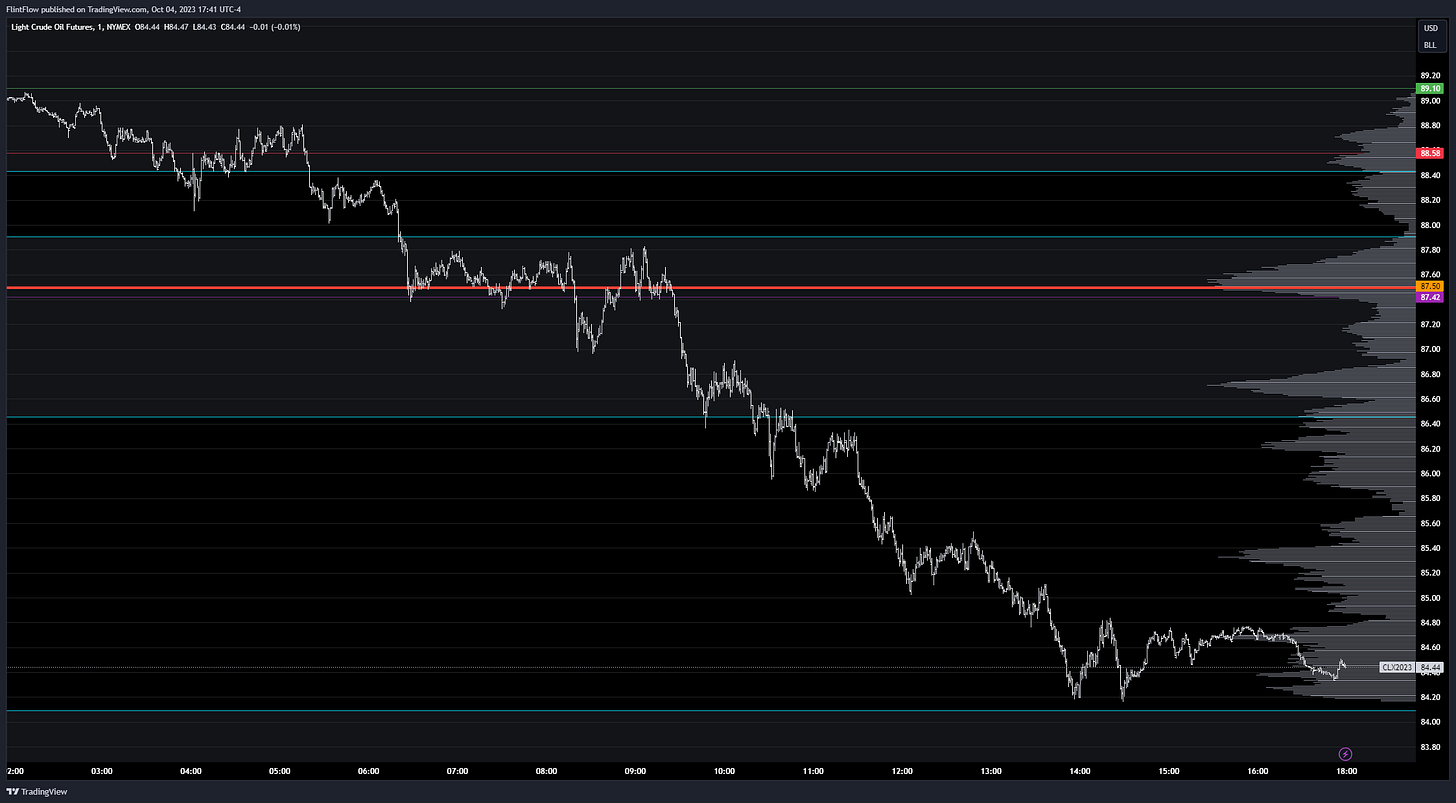

Oil and Gold once again worked in our favor, with oil experiencing a significant selloff. It plummeted by more than 430 pips from my identified short level, leading to a sell-off that traversed the Low Volume Node (LVN) after a brief consolidation within the value area range of 86.46-87.91, ultimately finding support at the Value Area High (VAH) at 84.09.

Gold, on the other hand, struggled to breach my short level, extending the value area from the last two sessions further to the downside. This accumulation of volume within the broader value area indicates a significant market development. Once again, the price adhered to my level, demonstrating limited upside movement today in line with my thesis. Newmont Corporation (NEM), which remains on my radar, witnessed some selling pressure in response to the drop in gold. My focal point with NEM remains at 38, as I am ideally looking for a breakthrough before anticipating a genuine reversal for Gold above the 1900s. Gold remains a potential candidate for a reversal, especially if we witness a bounce in the indices and another wave of selling in the tech sector.

Tesla posted an exceptional rally, surging by more than 14 points in a single session, perfectly aligned with the overall bounce in the indices today. If you've been following my updates, I've previously shared my thoughts on Tesla's third-quarter deliveries, which, although below expectations, were higher than all previous quarters leading up to 2023. From my perspective, there's clear growth being demonstrated, albeit with a slight slowdown. Despite concerns in the market about ongoing price cuts and lower-than-expected deliveries, Tesla's stock is nearly back to recent highs. If there's a stock poised for a strong rally, it would undoubtedly be Tesla, and that's why I've consistently emphasized it as one of my favorite stocks, even amidst all the Fear, Uncertainty, and Doubt (FUD) circulating in the market.

Here is Tesla's market structure, along with the provided thesis for the week ahead. We have identified two distinct value areas, each offering both long and short trading opportunities. These opportunities will be reflected in the intraday daily plans, providing a comprehensive strategy for the week's trading activities.